Exchange Traded Funds (ETFs) is regarded as one of the safest means of trading. This happens because of a number of reasons such as: liquidity, safety, and low commission regime.

Liquidity comes because of the huge number of participants in the ETF market while safety comes because of the diversification aspect of ETFs (often being compared to mutual funds).

ETFs are viewed as long term investments but many swing traders are using these instruments to make money (see here to know your trading style). They also have extremely low expense ratios.

To date, there are more than 1,600 ETFs which gives swing traders excellent opportunities to allocate their money.

What are ETFs?

An ETF is a financial product designed to track one or more financial assets. These assets could be stocks, commodities, bonds, cryptocurrencies, and currencies. For example, an ETF like the SPDR Gold Trust tracks the price of spot gold. On the other hand, Invesco QQQ tracks the Nasdaq 100 index.

There are several types of ETFs. The most popular types of are active and passive funds.

An active ETF is one that has a manager who uses his expertise to allocate capital. These funds are more expensive to manage, meaning that they have a higher expense ratio. A good example of this is Ark Innovation Fund.

Second, there are passive ETFs, which track indices. These funds tend to have a lower expense ratio and are the most popular among investors. A good example of a passive ETF is Invesco QQQ and SPDR S&P 500 Fund.

How ETFs work?

ETFs work in a relatively simple way. It all starts with a company that comes with an ETF. The biggest companies that create ETFs are State Street, JP Morgan, Fidelity, Schwab, and Blackrock. All these firms have trillions of dollars in assets under management.

The firms then decide whether to start a passive or active fund. If they decide to go for a passive fund, they work with index providers like Bloomberg and MSCI, which license the index to them. Finally, they allocate funds and then list the ETF in an exchange.

For active fund, the company comes up with an ETF and lists it. Its prospectus shows all details of the fund, including the quality of the companies it invests in.

What is swing trading

Traders have been practicing swing trading for years. Some of them have become very experienced and successful in it while many of them have failed.

Swing trading is a strategy where traders attempt to capture a profit from an ETF price move within a very short time frame. It is also known as day trading. The main idea behind it is to enter and move from a trade as soon as you have attained a profit.

For this reason, while fundamental analysis is a good method to study the market, most swing traders depend on technical analysis to enter or leave trades.

→ Learn When to Enter and Exit While Trading

Selecting a good ETF

As stated above, there are more than 1,600 ETFs one can chose from. Some of these ETFs include: government bonds, corporate bonds, stocks, and commodities among others.

For swing traders, selecting the right ETF is the first most important thing you should know because of liquidity issues. For instance, corporate bonds ETFs are less liquid than equity based stocks.

In addition, some sectors of equities are more liquid than others. For instance, technology based ETFs are more liquid than the material one.

Apart from liquidity, it is important to look at the past performance of the ETF, because this will give you a good indication of what to expect.

Some of the most common ETFs for day traders, among others, are:

- United States Natural Gas Fund

- Industrial Select Sector SPDR

- S&P 500 VIX Short-Term Futures

- ETN and SPDR S&P 500 ETF

Swing Trading the ETFs

A good ETF trading strategy involves identifying the most liquid categories and then narrowing the search to 4. We recommend using only 4 ETFs on a daily basis because it is easier to analyse and follow up.

In every trading day, some sectors will perform better than others. This is known as the relative strength whose goal is to find a good ETF to buy and a weak ETF to short. On a daily basis, We recommend that you list the above ETFs in a table and identify 2 best and 2 worst performing ones.

To do this, use the percentage scale instead of the numbers. We recommend this to be done at 10 AM or during the premarket. After listing these ETFs, find the best and worst performing and shift your focus towards this. Now you have 4 ETFs which you will trade with during that day.

This should take less than 2 minutes to do.

After identifying the 2 strong and the 2 weak ETFs, you should go ahead and go long in the former 2 while shorting the latter.

Trend following ETFs

A quite popular strategy to trade ETFs is known as trend following. This is a strategy where a trader buys an ETF when it is in a bullish trend and holding it to the end.

Traders use trend indicators like moving averages and Bollinger Bands. They also use price action patterns to predict when the trend is about to end. A good example of this is shown in the chart below.

As shown above, Invesco QQQ has been in a bullish trend. In this case, the trader would hold their long positions as long as the fund was above the 50-period moving average.

Trading breakouts

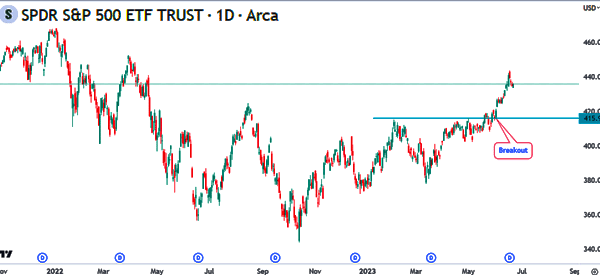

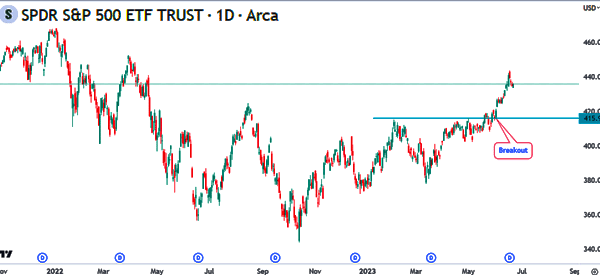

The other important strategy that people use to trade ETFs is known as breakouts. A breakout happens when an asset moves above or below a certain area.

For example, if an ETF is consolidating between $10 and $12, a bullish breakout is usually confirmed when it moves comfortably above $12.

Breakouts happen during the start of a new bullish or bearish trends. As such, when done well, they can be more profitable than trend-following. A good example of a breakout is shown in the chart below.

Short and Long Example

The chart below shows a short on the Energy sector ETF. The chart above shows a one-minute of XLE (energy ETF) which is in a downward trend. As seen in the chart, the ETF has just touched a new low and then rallied back to a descending trendline.

In the chart, We sold when the price touched $0.02 below the new low (consolidation low). Then, We placed a stop loss $0.02 above the new high and a take profit which provides a profit of 1.6 times the risk.

A good example is when the risk is $0.17. Here, you should place a target that gives a $ 0.27 profit. In this case, if the target is way much below the previous swing low, you should avoid the trade.

If the target is above the swing low, you should expand the target at least 2 or 3 times the risk.

Many traders are now appreciating the need and simplicity of trading using ETF. These funds play a very critical role in ensuring that traders avoid liquidity risk. They also ensure maximum diversification for the trader.

However, it does not remove the entire trading risk in the trades. In fact, many people have lost significant resources by investing in risky ETFs. Therefore, it is important to conduct some research when selecting the ETF vehicle to use.

Summary

ETFs are popular financial assets. It is estimated that trillions of funds are now allocated in these funds.

The biggest ETFS in the world are the SPDR S&P 500 ETF Trust, iShares Core S&P 500 ETF, Vanguard S&P 500 ETF, Vanguard Total Stock Market ETF, and Invesco QQQ among others.

We recommend that you invest in ETFs for your middle and long-term investing goal. Trading on a daily basis ETFS can be highly ineffective because of the lack of volatility and the fees charged.