Day trading is often a risky undertaking. In fact, most day traders make more losses than profits in the market (to be a successful trader it should be the opposite, win more than you lose).

Those who succeed are people who combine their trading skills with risk management concepts. One of the most popular risk management approaches is known as a stop-loss order.

In this article, we we are going to analyze in depth what a stop-loss order is and how to use it properly in the market.

Define a stop loss order

A stop loss order is defined as an order (a pending order to be specific) that seeks to limit the amount of losses that a trader makes in a trade.

The goal is to ensure that the trader is protected in case their original thesis does not go as planned. Also, it seeks to limit losses when there is an abrupt news event that pushes the asset higher or lower.

A good example of this is in the chart below. As shown, the First Republic Bank stock was trading in a tight range for a while since it was considered to be a safe bank. However, in March 2023, the stock plunged from over $100 to about $20.

In this case, people who had invested in the company made spectacular losses. As such, if they had placed a stop-loss at the important support at $107.36 (November 9 low), their losses would have been minimized.

How a stop-loss order works

To understand how a stop-loss works, you need to know how brokers execute order in the market. When you execute a trade, you are simply telling the broker to buy or short an asset. In the past, this process used to work by calling a broker to execute the order.

Similarly, when you want to exit a trade, you simply tell the broker to sell the order. Because of technology, this process usually takes microseconds to happen.

Therefore, when you place a stop-loss order, you are simply telling the broker to exit a trade when it reaches a certain point. You are telling the broker to close the trade when it reaches the pre-determined level.

Related » DMA vs Retail Trading

Types of a stop-loss order

There are three main types of a stop-loss order. First, there is a basic fixed stop-loss order. This is the most common type.

It is an order that is placed above or below a trade depending on the trade type. In case of a bullish trade, the stop-loss order is placed below the price. On the other hand, in case of a bearish trade, this order is placed above the price.

This type of a stop-loss has a major challenge. For example, assume that a financial asset was trading at $20 and you placed a buy trade with and a stop-loss at $18.

In this case, if the trade jumps to $22 and then quickly nosedives to $18, it means that your initial gains will not be captured. Instead, your trade will end at a loss.

Trailing stop

The second type of a stop-loss order aims to remove this risk. The trailing stop-loss moves with the trade based on the points that you have indicated.

For example, in the above example, if the stock jumped to $22, the stop-loss would also have moved up with it.

Stop limit order

Finally, there is an order known as a stop limit order. This is a tool that specifies the highest and lowest price of an asset that they are willing to accept.

It combines the concepts of pending orders known as stop and limit. In this case, you can set a stop order that buys or sells an asset at a specific price and then placing a limit price.

Why is a stop loss so important?

There are several main reasons why a stop-loss is so important in the financial market. Some of these reasons are:

- No one is always accurate – The reality about the market is that no one is always accurate when trading stocks and other assets. Therefore, having a stop-loss will help you minimize losses when your thesis is not accurate.

- Limit shocks – The other reason is that a stop-loss will help you prevent major shocks in the market such as when there is a major event.

- It can help you in risk/reward analysis – A stop-loss can help you in risk and reward analysis. This is an important aspect in the financial market.

- Gap protection – A gap is a situation where a stock opens sharply higher or below the current price. As such, having a stop-loss will help you avoid losing money when the gap goes against you.

- Emotions – A stop-loss order helps to take out emotions out of the decision-making process by automatically closing a trade when the predetermined level is reached.

Benefits

The benefit of using this type of order type is that you don’t need to stay in front of your computer waiting for the signal to happen. Based on your analysis, the Ppro8 (or your trading software) will initiate the trade itself.

In most cases, the Stop trades are often more profitable than market order trades.

Another type of stop order is an order to automatically end an unprofitable trade once a certain level is reached.

When you have a trade open, you can stay and watch it and when the loss reaches a certain point, you can end it. Alternatively, you can set a stop loss order which will stop the trade automatically even when you are not there. This is a good risk management tool.

Strategies for placing a stop-loss

There are several key strategies for setting a stop-loss when day trading. Some of the most popular strategies are:

Percent-based stop loss

This is a situation where you decide the level to use based on the percentage of your trading. For example, you might decide that the maximum loss you will make in a trade is 2%.

In this case, if you have a $50,000 account, it means that you should place the stop-loss where your maximum loss is $1,000. This is one of the most popular approaches to consider when using a stop-loss in the market.

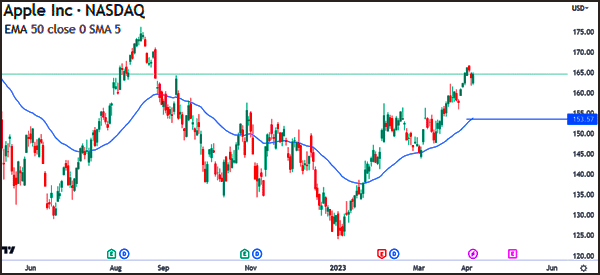

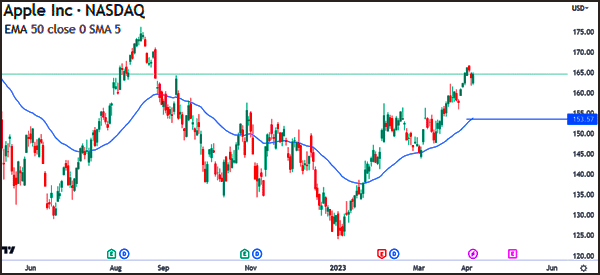

Moving average based stop-loss

This is a situation where you decide to stop a trade based on the moving average. The idea is that a stock or any other asset will often remain above a certain moving average for the trend to continue.

If it moves below the moving average, then it will be a sign of a reversal. In the example below, one woud place the stop-loss at the 50-day moving average level.

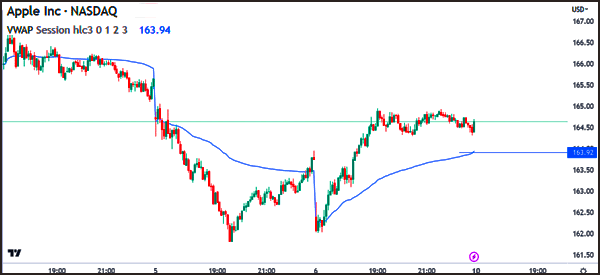

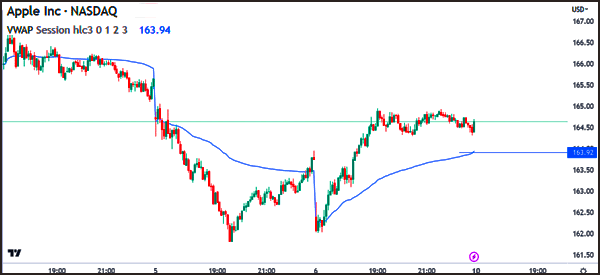

VWAP stop-loss

For most day traders, the VWAP is the best indicators to use. The Volume-Weighted Average Price looks at the average price of an asset in a certain period.

A good example of this is in the chart below. As seen, a trader could place the stop-loss at the VWAP level of $163.92.

Fibonacci Retracement stop-loss

The Fibonacci Retracement is a tool that uses the fibonacci sequence to identify key levels in a stock. These levels are usually 23.6%, 38.2%, 50%, 61.8, and 78.6% retracement points.

The Fibonacci tool is drawn by connecting the upper and lower sides of the asset. In case of a bullish trade, you can place a stop-loss at the 23.6% retracement level.

Volatility based stop-loss

This is a situation where you use one of the popular volatility indicators to place a stop-loss. One of the best ones is known as the Bollinger Bands.

It is calculated by first calculating the moving average and then finding the standard deviations. In this case, you can place a stop-loss at the lower side of the band.

Best practices for setting a stop-loss

Most traders know the benefits of having a stop-loss. However, most of them either ignore them or set them in a bad way. Here are sme of the best practices to set a stop-loss when trading.

First, always do a multi-timeframe analysis to identify the best places to locate a stop-loss. This is an analysis where you look at the various timeframes when making the decision.

You could start by identifying the levels in the 30-minute chart followed by a 15-minute, and then a 5-minute chart (this 3-step analysis is called ‘rule of three‘).

Second, always stick with the stop-loss. This is a situation where traders shift the stop-loss to prevent it from being triggered. In most cases, one can adjust the stop-loss order too much and then lose more money than they expected.

Third, evaluate the performance of the stop-loss orders based on your performance. It is always important for you to carefully evaluate whether your stop-loss strategy is working. When the conditions are changed, you have to optimize and set them again.

FAQs

When should you use a stop-loss?

Which type of stop-loss should you use?

Can stop-loss orders fail?

Final thoughts

A stop-loss order is an excellent order that allows you to stop a trade if it moves to a certain level. Its benefit is that it prevents further losses and is also an important approach to manage risk. The only drawback is when it is executed and then the financial asset reverses.

External useful Resources

- The Stop-Loss Order—Make Sure You Use It – Investopedia