Broadly, there are two types of traders. One, there are value traders who identify companies that are solid and invest in them for the long term. Warren Buffet is a good example of this group of investors. He has owned companies such as Coca-Cola and Geico for the past 30 years.

The second category are traders who don’t have the long term patience to own companies. Traders spend most of their time identifying trends and swings in the assets that they target.

As you can easily guess, these two very different approaches to the markets require different types of analysis and strategies.

The key to success for any value investor is diversification. This is simply because companies will go through cycles of wins and losses.

For instance, a company such as Coca-Cola can have a perfect year because of the World cup before returning to the previous normal area. During that year, the shares will rise and as it comes to settle down, the shares will go down.

Traders on the other hand are not known to be great in stock diversification. This is because they aim to enter a position and exit within a very short duration (learn how).

In fact, traders are able to trade in companies they have never heard before just because of a news story that has just come up. It is however important to note that traders can successfully diversify their risks no matter the short timeframes of their investments.

How traders can diversify their income

As mentioned above, traders are not very good at diversification since they only open their trades for a short period. However, it is still possible to diversify your sources of income. One of the best approach is to divide your funds into two baskets. One basket will be strictly for trading and the second basket will be for investing.

In the second basket, you will invest in quality companies that will provide you with capital appreciation for the long-term. In this, you could invest in quality growth stocks like Apple and Microsoft and diversify with value companies like Procter & Gamble.

This basket will give you capital appreciation and even dividend income. When diversifying this investment portfolio, there are several ways of doing this as you can see below. Each of these has its own risk vs reward.

Balanced portfolio

This is a portfolio that is divided between both stocks and bonds. A common way of doing this is to allocate about 60% of your portfolio in stocks and the rest in bonds. The goal is to achieve significant returns in stocks and then offset any downsides with bonds.

Conservative portfolio

This is a portfolio that seeks to strongly conserve cash. In most cases, this means investing a small portion of your cash in stocks and the most in bonds and other fixed asset investments.

Moderate portfolio

This is a portfolio whose goal is to protect you from inflation while generating some returns. It is made up of a combination of stocks and bonds.

Aggressive portfolio

This is a portfolio that is risk-on. It means that you are ready and willing to take risks. As such, you can invest in growth stocks and other risky assets like cryptocurrencies.

Types of diversification when trading

There is another way in which traders can diversify their income. This is where they diversify the assets that they trade. Some traders focus on individual assets like stocks and cryptocurrencies. There is nothing wrong with this.

However, being flexible on the assets you trade can be a good thing. Some of the assets that are available are: currencies, commodities, indices, stocks, crypto, and exchange-traded funds (ETFs)

There are two main benefits of doing this. First, when you focus on different assets, you can take advantage of volatility. When one asset class is not volatile, you will trade the one that is volatile.

Second, having multiple assets will give you more time to trade. For example, if you focus on stocks and cryptocurrencies, you can trade the latter during the weekend.

Power of correlation

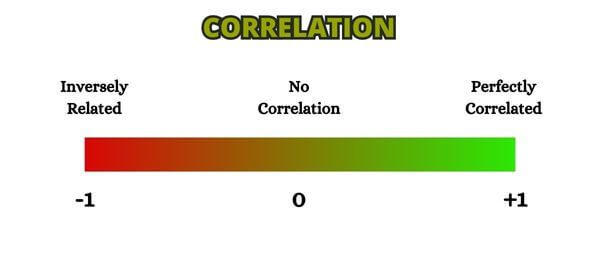

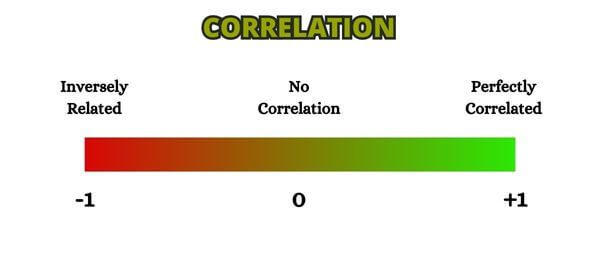

As traders, correlation is a very important concept that you can use to diversify your trades. Assets such as currencies, commodities, indexes, and equities are all interrelated.

As such, a movement in one currency can have an impact on the movement of a particular commodity.

For instance, for a long time, the price of gold and that of the dollar has had a negative correlation. This means that when the price of gold moves up, the price of the dollar replicates it by moving down.

This has some underlying reasons: Investors view gold has a safe haven because the United States policy on dollars. Therefore, when the dollar becomes very strong, there is usually a gold selloff as investors accumulate dollars and vice versa.

→ Gold Trading: Strategies to Trade it Profitably

Another correlation that traders can use is on the prices of crude oil. Western Texas Intermediate (WTI), and Brent Crude have a near perfect correlation. This means that when the price of Brent goes up, the price of WTI will also reciprocate by going up.

You can also add natural gas and gasoline to this equation. In this case, a trader who buys Brent and WTI is actually risking losing money.

The one that buys one and sells the other is protecting his portfolio because if WTI goes up and Brent breaks the correlation, he will still make money from one.

A trader can perform the correlation himself using excel and the data that is available in his trading platforms. For MT4 traders, this data can be found in the tools section. There are also websites which provide up to date correlation data automatically.

Need for research

Research is very essential for any trader who wants to diversify. This is because a trader who is diversifying needs to understand the two assets that they are buying or selling.

For instance, if you want to go short gold and long EUR/USD, you need to understand the fundamentals in gold, Eurozone, and United States. It is also important to understand cycles involved in the ‘assets’ that you are trading.

A lot of research materials is available online:

- The economic calendar can help you identify the times to make entries and the times to exit

- The earnings calendar can give you a clear picture of what to expect in a certain company

- Various speeches and interviews (like podcast) from influential people can help you gain insights on the assets you want to trade on.

Summary: Is diversification so important?

It is important to note that the power of diversification is not for everyone. There are people who have attained a lot of success without taking this route. These are people who make money by buying or selling individual assets.

Therefore, if you find success in diversification, you can go ahead and use it. As we have explained in our previous articles, the key to success in day trading is finding a simple strategy that you understand!

So, you should not try something you find complicated.

Always remember there are traders who have become very successful by following a very simple strategy, and you can do it too.

External resources to understand the power of stock diversification

- Tackling Risk With Portfolio Diversification – AdmiralMarkets

- Diversification through Trade [PDF] – Korem.mk