It’s common for first-time forex traders to get right in. It’s a 24-hour, five-days-a-week foreign exchange market that they perceive as a simple method to trade all day long, following different economic calendars.

This technique may swiftly erode a trader’s capital, but it can also exhaust the most tenacious of traders. This implies that trading is possible all day and night.

So, in lieu of staying up all night, what are your options?

In order to make money, traders need to be aware of the market hours and create targets that are reasonable for their schedules.

Related » How to build your trading plan

The hours of currency trading are unlike any other. On Sunday at 5 p.m. EST, the week starts and ends at the same time. Market activity is at its peak at this time of day. To put it another way, there will be a higher level of volatility in currency pairings when all four markets are open at the same time.

It’s common for currency pairings to become stuck in a 30-pip range while only one market is operating. When major news is revealed, two markets opening at the same time might easily experience movements in excess of 70 pips.

Forex Market Time Sessions

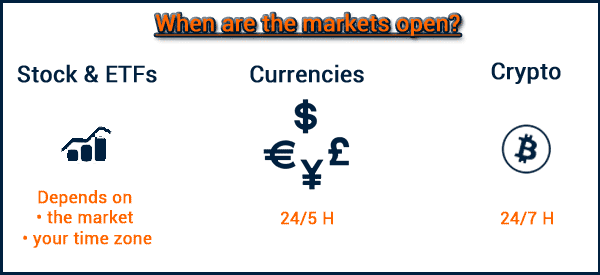

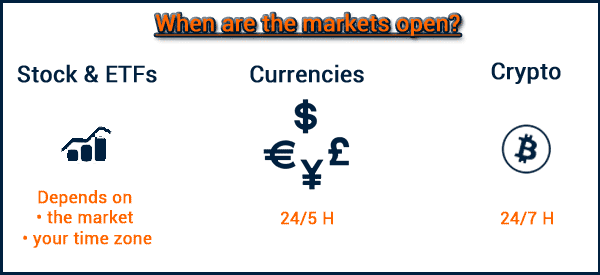

Unlike other asset classes, the Forex market has a distinct structure. Equities, for example, have certain periods for opening and closing. Even though “what time does the JSE open?” has a clear response, “what time does Forex open?” doesn’t have a simple solution.

Traders who wish to make trades before or after their workday may do so thanks to the 24-hour nature of the Forex market.

South Africa has a Forex market that opens at a certain hour each day. It is also worth noting that the optimum forex trading sessions in South Africa time are between 10:00 and 17:00 SAST when the 24-hour cycle is in motion (South Africa Standard Time).

Europe

The London session begins at 10:00 SAST, while the U.S. session begins at 17:00 SAST. For intraday and day traders, this is the time when the most important economic data is published, as well as the deepest liquidity.

At 43% of all transactions, the European session is the busiest trading period for currency pairs like USD/EUR.

If you’re trading on a long-term time horizon, you should give greater importance to fundamentals and less importance to technical analysis and time zones.

U.S.

When it comes to international currency trading, New York is the second-largest market in terms of volume, with 90% of all deals using the U.S. dollar, according to Kathy Lien’s “Day Trading the Currency Markets” (2006).

NYSE movements may have a significant impact on the value of the dollar immediately. It is possible for the dollar to gain or lose value in a matter of seconds when corporations combine or acquire each other.

Asia

Japan’s first Asian trading center opened from 7 p.m. to 4 a.m., taking in the majority of Asian trade ahead of Hong Kong and Singapore (which begin at 8 p.m).

There is a significant lot of activity in the USD/JPY, GBP/CHF, and GBP/JPY currency pairings, which are the most popular (British pound vs. Japanese yen). Since Japan’s central bank, the Bank of Japan, exerts so much control over its currency, the USD/JPY is an excellent currency pair to keep an eye on while only the Tokyo market is open.

Major Overlaps

Intervals between open market trading hours provide the ideal opportunity for trading. Overlaps lead to bigger price ranges, which creates more chances. A deeper look at the three overlaps that occur on a regular basis.

U.S./London (8 a.m. to noon)

This is the time of the day when there is the most overlap between the markets. More than 70 percent of all deals occur when these markets coincide. This is the best moment to trade because of the high level of volatility (price movement).

Sidney/Tokyo

If you’re looking for an opportunity to trade in a period of larger pip volatility, the Sydney/Tokyo time period (2 am to 4 am) is a good place to start. Euro/Japanese yen is the best currency combination to target since these are the two most heavily affected currencies.

London/Tokyo

(3 am to 4 am): London/Tokyo Since most US-based traders won’t be awake at this time, and the one-hour overlap affords a limited chance to see major pip movements, this overlap is the least active of the three.

In order to plan one’s trading strategy, it is important to keep in mind that the publication of news might have a significant impact on the market.

News are essential

A dull trading period might be boosted by a major news announcement. As soon as there is a significant revelation about economic data, money may either lose or gain value in a couple of seconds.

Trading doesn’t need to know about all of the economic announcements that occur every workday across all time zones and affect all currencies. Prioritizing news releases based on the importance of the information they include is essential.

Generally speaking, foreign investors are more optimistic about a country’s economy if it has a higher rate of economic growth. Countries with strong development prospects and investment possibilities tend to attract investment money, which in turn leads to an increase in the country’s currency value.

Investment money is attracted to countries with higher interest rates on their government bonds, as international investors seek high-yielding options. Economic stability and favorable interest rates are inextricably linked, though.