Gambling, sports betting, and day trading are often used in the same sentences. Furthermore, the two strategies can help you make a lot of money by risking a small amount of money.

For example, if you spend $1,000 to buy a stock that rises by 10%, you will have $1,100 in that session alone. In gambling, you can risk $100 and make more than $1,000 in a single session.

In this article, we will look at the key benefits that trading has over gambling.

What is gambling?

Gambling is the process of putting a small amount of money with the goal of making a substantial return. There are two main types of gambling – skills based and chance based. Examples of skills-based gambling strategies are roulette and blackjack.

The most popular type of chance-based gambling is playing the lottery. In it, you risk a small amount of money and get a chance to make a lot of money. Gambling happens both online or in several venues like those in Macau, Las Vegas, or Monaco.

Related » Which Strategies for Gambling Can Bring Stock Trading Success?

What is trading?

Trading, on the other hand, is the process of analyzing a financial asset and predicting the direction it will move. For example, you can analyze and find that Tesla shares will rise in the next hour. Therefore, you will make money if the stock rises. You will lose money if the stock declines.

The trading industry is significantly larger in size than gambling. Every weekday, more than $6 trillion is exchanged in the financial industry.

Is trading gambling?

A debate has existed for a long time on whether trading can be classified as gambling. The answer to this question is debatable.

Day trading involves buying and selling stocks within the same trading day, with the goal of making a profit. While some may argue that day trading is similar to gambling, there are key differences.

Unlike gambling, day traders use analysis and research to make informed decisions based on market trends, technical indicators, and fundamental analysis.

Additionally, traders use risk management strategies to limit their losses and maximize their profits, whereas gamblers often rely on luck and chance.

Still, a careful analysis shows that trading and gambling have some similarities. Furthermore, they involve taking a small amount of money and risking it in exchange for a bigger return.

Why Day Trading is not gambling

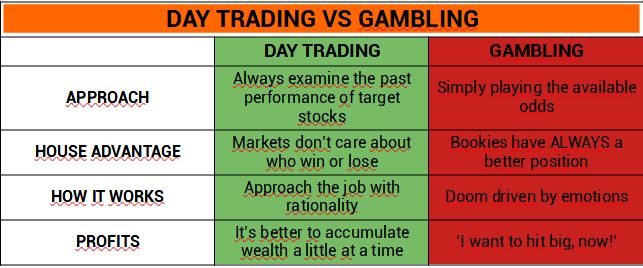

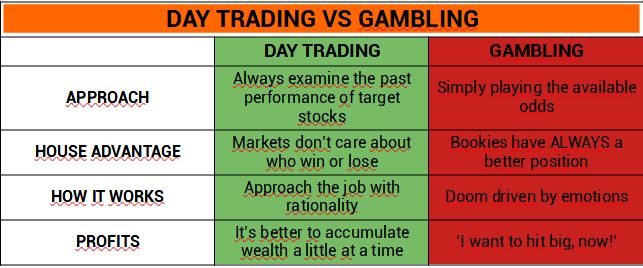

1. Facts and Figures

While true gamblers are simply playing the available odds, day traders always examine the past performance of target stocks leading up to a purchase. As such, traders have a wealth of information at their disposal.

Eschewing pure chance, individuals will be perfectly capable of using the tools of the market to determine which stocks they should buy.

With the appropriate facts and figures, most investment attempts should turn out quite well.

2. No House Advantage

Unlike traditional gambling endeavors, there is no inherent house advantage in day trading! In Las Vegas, for example, this is how bookies ultimately make their money.

In day trading, savvy investors will be dealing with markets that do not ultimately care whether they win or lose. With enough good information and a strong penchant for analysis (technical or fundamental), day traders will surely succeed in turning a profit.

Related » Where to find News Sources for Your Trading?

3. Rationality and Reason

While gamblers are often pulled to their doom by raw emotion, day traders approach their jobs with cold rationality.

If a certain stock is likely to perform badly over the coming days or weeks, most traders will simply ignore that particular stock for the time being. Men and women who do well with day trading are almost always lifted to success through logic and reason.

Related » These 7 emotions can destroy your Day Trading Dream!

4. Slower Profits vs Fast Profits

Day traders are also perfectly happy to accumulate wealth a little at a time. This stands in stark contrast to gamblers, who are often looking to hit it big almost immediately.

With slow, steady gains, traders will usually have an excellent chance of turning a long-term profit. Instead of engaging in hasty, high-risk bets, investors will buy and sell stocks in a coordinated, thoughtful manner.

There are also taxations, laws and regulations.

5. Day trading can make money in all conditions

The other important fact about day trading is that experienced people can make money in all market conditions. This means that you can make money when the market is consolidating and when it is highly volatile. Also, it is possible to make money when the asset is moving in an upward or downward trend.

Also, you can make money when stocks are rising or when they are falling. When they are going up, you will make money by buying and waiting for the price to go up.

Similarly, when they are falling, you can make money by shorting. Shorting is where you place a sell trade and benefit as the price falls.

6. Day traders use advanced technical tools

Another difference between traders and gamblers is the use of technology. These days, the financial market has become highly advanced such that people are using technology tools to analyze and execute trades.

The first technical advancement is known as robots or expert advisors. These tools help to automate trading by doing analysis and executing trades.

For example, you can automate a trade by opening a buy trade when the 25-day and 50-day moving averages make a crossover. You can also create an automated strategy that executes a buy trade when the asset moves above the VWAP.

There are other advanced tools that can help you be a good trader. Some of the most popular of these tools are watchlists, trading alerts, breaking news tools, and advanced charting tools.

Gambling is significantly different from day trading in this regard. While the gambling technology is doing well, the reality is that decision-making relies on instincts and luck.

Myths and misconceptions about trading and gambling

There are many common misconceptions about trading and gambling. Some of the most popular misconceptions are:

Traders rely only on odds

A popular misconception is that day traders always rely on odds when making trading decisions. While trading has odds, the reality is that there is much more research and analysis that go into day trading.

For example, day traders always focus on technical and fundamental analysis when making trading decisions.

For instance, stocks always make big moves when companies publish their financial results. They also move when a company makes major moves and when the Federal Reserve makes a monetary policy decision.

Therefore, while the aspect of odds exists in the financial market, the reality is that a lot of things that go into making a decision on whether to buy or short

Related » Gambler’s fallacy bias

Day trading, as with gambling, is an easy way to make money

The other popular myth and misconception about trading is that it is an easy way to make money. The reality is that neither trading or gambling are easy ways to make a fortune. While it is possible to make a lot of money in both, it takes hard work.

Most successful day traders spend a lot of time and energy learning about the market. They also take time testing their trading strategies using a demo account. Some of the most notable strategies in the market are scalping, swing trading, and trend-following.

Day trading, like gambling, is a hobby

Further, there are misconceptions that day trading is just a hobby. That misconception comes from the fact that many gamblers do so as a hobby. The reality is that while day trading can be a hobby, it is much more than that.

Day trading is a difficult practice that can lead to major successes. For that to happen, you need to learn more about the market, you need to create a solid strategy, and also backtest it effectively. Backtesting is a process where you use historical data to test the performance of a strategy.

Day trading requires a lot of capital to start

Another myth and misconception about day trading and gambling is that it requires a lot of money to get started. The reality is that anyone, regardless of their financial background, can get started. For example, most companies like Robinhood, Schwab, and Fidelity have no minimum balance.

Similarly, at Real Trading, it only takes $500 to get started in prop trading. With the $500, you will get all the training that you need to become a successful trader. You will also get the device that connects you to the market.

Related » Businesses With Low Startup Costs

Similarities between gambling and trading

We have seen that gambling and trading are two different things. However, they have several similarities that you should be aware of.

First, the outcome of the two tends to be similar. When you open a trade, the possibility is that it will be profitable or loss-making. The same is true with gambling, where you can only win or lose.

The difference in this regard is that you can cut losses in day trading. This means that you can easily exit a loss-making trade without losing too much money.

Second, streaks are possible when both trading or gambling. In some instances, you can have a strong winning streak or losing streak when doing the two.

Third, trading and gambling can be addictive. Many gamblers have lost a fortune and their mental balance because of being addicted. Sadly, the same situation happens in day trading. Some people get addicted to trading, which can have psychological implications.

Finally, trading and gambling have psychological factors. Some of the most popular psychological factors in the two are stress (when things go wrong), common biases (like anchoring and confidence), and excitement.

The Bottom Line

Though day trading entails a certain degree of risk, it should not be intimately associated with gambling. Once people learn a bit about how the market works, they can use a variety of tools to achieve success in the financial arena (they can also read, watch and listen to news on stocks..also in podcast).

Positive results will surely follow quite soon.

More useful resources

- Differences between Trading, Investing, and Gambling – Dummies.com

- Gambling Addiction: Signs, Causes, Risks, And Treatment Options – Addiction Resource