In the ever-evolving world of stock markets, understanding the factors that drive stock price movements is essential for investors and traders seeking to make informed decisions.

Beyond the obvious impact of news, economic data, earnings reports, and insider transactions, a myriad of complex and interconnected elements shape the dynamic landscape of stock movements.

This article delves into the comprehensive spectrum of determinants that influence stock prices, shedding light on both familiar and often-overlooked factors that can send shockwaves through the market.

How the stock market works

For starters, a stock is defined as a company’s share or small parts of a firm. Therefore, when you buy a company’s stock, you become a partial owner of the firm.

As such, you can take part in making key decisions such as hiring of the CEO and voting for the board members (But these things only interest you if you are an investor, and you have big money involved).

Shareholders make money in two ways. First, they benefit when a stock price rises. For example, if shares jump from $10 to $15, they make a 50% return on their investments.

Second, they make money when a company decides to distribute its profits to the shareholders. These profits are known as dividends and are paid periodically. Some firms pay their dividends monthly while others pay quarterly, biannually, or annually.

Traders and investors participate in the stock market by first creating an account, depositing funds, and then buying or shorting shares. As a buyer, you will benefit when the stock price rises. On the other hand, as a short seller, you will make money when the stock drops.

What affects price movements?

A common question in the market is what moves stock prices. In this section, we will look at the most important factors that affect stock prices.

News

Investors use the news to know how the companies are doing. Each day, news headlines about different companies come out. They are covered in financial press like CNBC and Wall Street Journal. The news can either be positive or negative.

A company’s stock can rise when a company releases a new product that investors believe will be a hit. In other cases, a stock can slip when it releases a product the market is critical about.

Further, shares of a pharmaceutical company like Pfizer and Abbott can rise when it receives an approval of a drug. Also, they can rise or fall when the company’s CEO resigns or when it appoints a new leader.

Therefore, the most successful traders are those who are the first to receive stock news. Some of the most popular sources of news are social media platforms like Twitter, StockTwits, and Reddit. Also, there are some prominent financial platforms like WSJ, Financial Times, and CNBC.

Economic Data

Every day, different government and private agencies release their economic data. The data is meant to help investors and policy makers understand the status of the economy.

Economic numbers have an impact on a company’s stock. This happens because these numbers impact the decisions of central banks like the Federal Reserve and the European Central Bank (ECB).

Stocks are affected by central bank actions for a number of reasons. For example, higher interest rates often make stocks unattractive and vice versa. During the Covid-19 pandemic, stocks surged when the Fed slashed interest rates to zero and implemented quantitative easing.

The most important economic data to watch are inflation, jobs, manufacturing, industrial production, and consumer confidence. You should always use the economic calendar, watchlists the upcoming data.

Earnings

Investors want to invest in companies that are growing and that will reward them with dividends, capital appreciation, and share buybacks. A company that is slowing in revenues and growth is not desirable.

American companies are mandated by regulations to publish their financial results every quarter. These results provide key details of what happened during the quarter and a preview of what to expect. Investors tend to invest in companies that record improved results and better projections.

Earnings move stocks because they tell the market whether a company is doing good or not. In most cases, stocks tend to rise when a company publishes strong financial results and vice versa.

In addition to the headline figures, there are other factors that traders watch. For example, for a company like Netflix, they watch the number of quarterly sign ups. They also watch the ad revenue growth for companies like Facebook and Google.

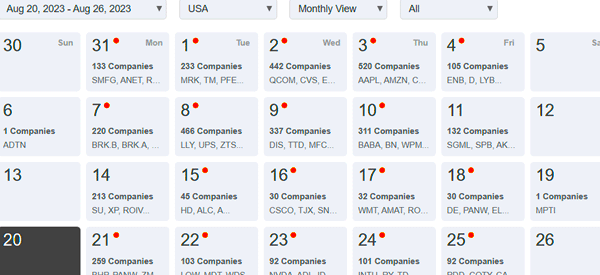

The earnings calendar is a useful tool to use because it shows you the companies that will publish their results in a certain period. The screenshot below shows what an earnings calendar looks like.

Large Investors

Investors tend to be in the company of other large investors. Some investors have built their career on buying companies and improving them.

Therefore, when they buy stocks in a company, investors tend to follow them. Some of these investors are Warren Buffet and Nelson Peltz who is the largest investor in P&G and David Einhorn who has invested in companies like General Motors and Hewlett Packard Enterprise among others.

Hype

A common factor that is moving stocks recently is hype. The situation has become more popular recently with the spread of social media use. Today, players in social media platforms like StockTwits and Reddit are ganging up to push shares higher.

As such, it is common for the stock of a company that has filed for bankruptcy to rise. In the past, those stocks used to drop since bankruptcy means that a company is going out of business.

Large purchases

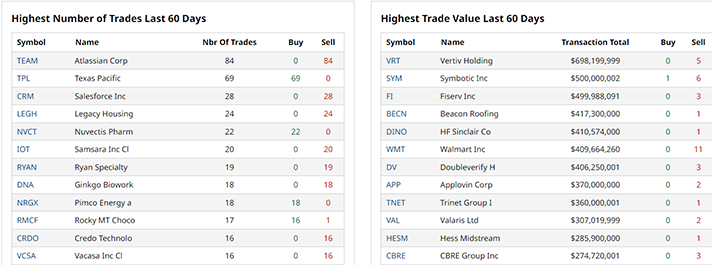

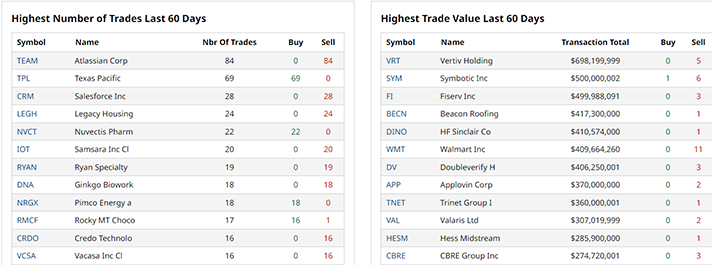

Another factor that affects stock price movements is purchases by influential people such as hedge fund managers and insiders. Some of the most influential individual hedge fund managers who affect stock price movements are Warren Buffett, Bill Ackman, Dan Loeb, and David Einhorn.

Insiders are also important movers of stocks. In most cases, traders believe that insiders like executives and board members know something that the public does not know.

As such, stocks tend to drop when insiders are selling and vice versa. You can use a website like Barchart to find the most active stocks in the market.

Geopolitics

Another factor that affects stock prices is geopolitical. Sadly, these geopolitical events are rising as countries like the US, China, Russia, and Iran flex their muscles. The most recent geopolitical event is the ongoing war in Ukraine.

Also, the US and China are continuing adding sanctions on key industries. The US wants to weaken China, which it sees as the biggest threat to its superpower status.

Therefore, these actions have an impact on stocks. For example, the ban of the US sale of computer chips to China had an impact on semiconductor stocks like AMD and Nvidia.

Geopolitics also have an impact on energy supplies. For example, Russia is the third-biggest oil producer after the US and Saudi Arabia. As such, these geopolitical actions have an impact on energy stocks like Chevron and ExxonMobil.

Market sentiment

Stocks are also affected by the market sentiment. In most cases, this sentiment is usually categorized as risk-on and risk-off. Risk-on is when traders are willing to take bigger risks while risk-off is when they are risk-averse.

There are several ways to know the risk profile in the market, including the fear and greed index and the VIX index.

The fear and greed index uses several sub-indexes like the VIX, junk bond demand, stock price strength, and stock price strength. It moves from zero to 100. When it is at zero, investors are usually extreme fear while 100 is extreme greed.

Black swan events

Further, there are things known as black swan events, which are large events that happen once in a long time. The 911 attack in the US was a black swan event because of its rarity. Other popular recent black swan events were the Covid-19 pandemic, Russia’s invasion of Ukraine, Silicon Valley Bank collapse, and the Colonial Pipeline hack.

Industry and sector trends

Finally, stocks are affected by industry trends. For example, housing stocks like Lennar and D.R Horton can rise when the sector is booming. Similarly, technology stocks can do well when there is demand for them.

Some industry trends are usually driven by hype and not the fundamentals. For example, in 2023, companies like Nvidia and C3.ai soared because of the hype of artificial intelligence.

Technology stocks surged during the dot com bubble because of the rising demand for technology companies. Also, most recently, all EV stocks jumped because of the strong performance of Tesla.

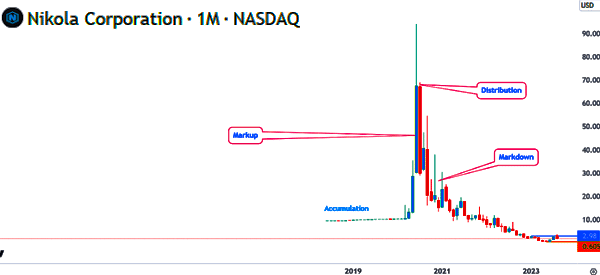

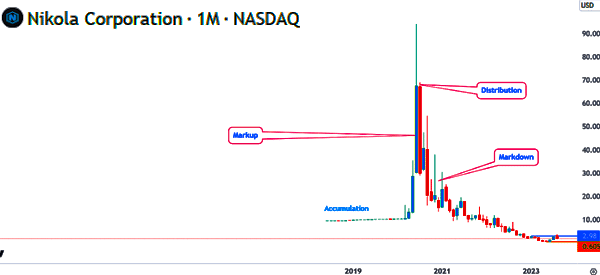

Stock market cycles

It is worth noting that stocks move through cycles. The most common cycles in the market are accumulation, markup, distribution, and markdown. It is easy to understand how these cycles happen.

The accumulation stage is where investors are slowly buying a stock they believe will rise. In this stage, stocks tend to move in a tight range, without making big moves.

In the next markup stage, traders and investors become attracted to these stocks and start buying them in droves. This move is characterized by hype, positive news, and the fear of missing out (FOMO).

The next stage is known as distribution. It is where the previous accumulators and smart money start selling their shares. This situation leads to some bearish pressure, pushing the stock lower. Finally, there is the markdown, where the stock continues falling. These cycles are shown in the chart below.

FAQS

Why do stock prices move every second?

How does M&A affect stocks?

How do global events impact stocks?

How does monetary policy affect stocks?

External useful resources

- Discover more on TradingStockGuide;

- Another interesting reading on BT;