A common question among many new traders is how to do it successfully on a part-time basis. This is because many people who have full-time jobs still want to make money using day trading as a side hustle.

Definitely a sharable intent, especially at the beginning when we still have to refine our strategies and we don’t have enough money saved to be able to afford days without profits.

In this article, we will look at some of the strategies you can use to trade on a part-time basis successfully.

How trading works

Before we get to the details, let us look at how trading works. For starters, trading refers to the process of buying and selling financial assets like stocks and commodities within a short period of time. Strictly speaking, day traders don’t hold their trades overnight.

There are several types of assets that you could trade. You can day trade shares, which are partial ownership of companies. Examples include Apple, Palantir, Microsoft, and Motorola Solutions.

You can also trade currencies like EUR/USD and USD/JPY. Additionally, you can trade exchange-traded funds (ETFs) and commodities like crude oil and copper.

As a day trader, your role will be to analyze assets and then predict whether their prices will keep rising or falling. For stocks you believe will rise, you can buy them. Similarly, you can place a short or a sell-trade when you believe that a stock will crash.

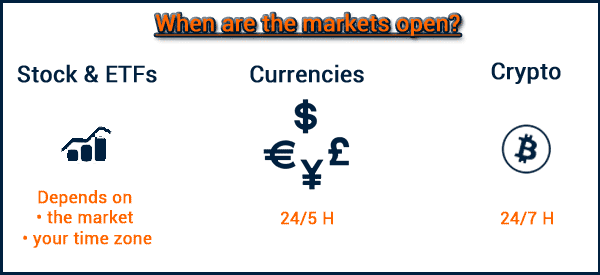

What time is the market open?

If your goal is to day trade part-time, it is important that you know the time when the financial market is open. With this knowledge, you can easily come up with a strategy on how you can allocate your time well.

Different markets are open in different periods per day. For example, the forex market is usually open for 24 hours per day from Monday to Friday. This means that you can trade forex after your shift ends.

Cryptocurrencies, on the other hand, are offered on a 24-7 basis. This means that you can trade them at any time of the day, including during the weekend. Therefore, if your goal is to trade part-time, these currencies offer an ideal situation.

Stocks and Exchange Traded Funds (ETFs) have the least amount of time to trade. In the United States, the regular market usually opens at 9:00 AM and then closes at around 4:00 PM. Sadly, this is the same period when most people are at work.

Still, brokers allow traders to execute their trades before the regular session starts and after it closes. The two periods are known as pre-market and extended hours sessions.

While they are good, these sessions have their limitations. For example, they only allow you to execute pending orders. Also, there is usually high volatility and the pricing tends to favor the brokers.

Strategies to part-time trade

These days, it is possible to trade when you have a full-time job. As shown above, you can find time to trade different assets when you have time. For example, you can trade forex and cryptocurrencies if the stock market is closed.

Let’s now look at some ways that you can trade part-time.

Using mobile apps

Another reason why it is possible to day trade on a part-time basis is that many brokers have introduced mobile trading. These brokers include companies like TD Ameritrade, Schwab, and Robinhood have apps that you can use to buy and sell assets. Therefore, you can trade even when you are at work.

These apps are usually really good and carry most features that you need to trade. However, it is important that you learn how to do analysis on your phone in order to make informed decisions.

Most traders do their analysis in their home computers and then use mobile applications to track their performance. In this, you can see the performance of your portfolio and even close trades you feel are not going on well.

Swing trading

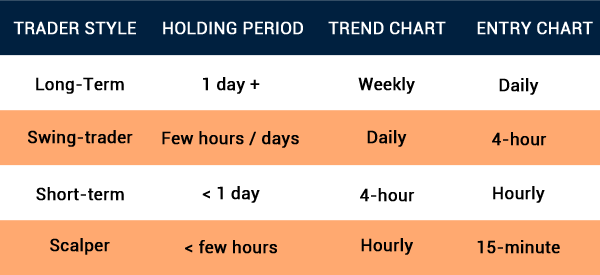

There are other ways of making money in the financial market when you are employed full-time. First, instead of becoming a day trader, you can opt to be a swing or position trader.

A swing trader is a person who identifies trends and then allocates capital to take advantage of these trends. Swing traders are different from day traders because they hold their positions for several days while day traders believe in closing their trades by the time the market closes.

Swing traders tend to use relatively longer-term charts than day traders. While day traders use 5-minute charts, swing traders tend to use 15-minute to hourly charts.

The chart below shows an example of the Nvidia stock price. As a swing trader, you can buy such a stock and hold it so long as it is above the moving average or the VWAP indicator.

Using pending orders

Another relatively simple strategy to use when trading part-time is to use pending orders. The idea behind it is very simple.

For starters, pending orders are not implemented immediately. For example, if a stock is trading at $20, you can place a buy-stop at $23 and a sell-stop at $18. In this case, if the stock rises to $23, a buy order will be initiated. On the other hand, if it drops to $18, a short-order will be initiated.

A good way to do this is to check out companies that are publishing their earnings results in extended hours. In most cases, stocks tend to either rise or fall sharply after earnings. Therefore, you could place a bracket order before the market closes.

In the Nvidia example above, you could have placed a buy-stop order at $306 and a take-profit at $320. At the same time, you could have placed a sell-stop at $285 and a take-profit at $250. In this case, the buy-stop trade would have been implemented when the stock jumped.

Final thoughts

In this article, we have looked at the best strategy to trade and make money as a part-time trader. Still, this is a relatively wide topic, meaning that there are some things that we have not covered.

We recommend that you study this money management article to see some of the best ways to manage your money as a part-time trader.

External useful Resources

- Should You Quit Your Job to Trade Stocks? – Investopedia