Coffee is one of the most popular drinks in the world. In the past, it was more popular in Europe and United States. These days, many people in Asian countries have started to love the drink. This has led to a new rush to meet the demand of these people.

As a result, big companies like Starbucks have expanded aggressively in Asian countries (The company has more than 3000 stores in China).

Meanwhile, small Chinese companies like Luckin Brands have seen significant growth. The company is worth more than $4 billion. Starbucks stock has risen significantly and is now worth more than $98 billion.

It has been a great time for coffee companies like Starbucks, Dunkin, and Luckin. However, the price of coffee beans has been declining.

Factors that affect coffee prices

Weather conditions

Just like other agricultural crops, coffee has specific weather requirements at different stages of its growth. For instance, during the flowering and bean formation, adequate rainfall is needed.

If key coffee producers experience drought, it will lower coffee supply and trigger the soaring of prices. For instance, in 2020, Brazil and other sugar-producing nations in South America faced La Nina.

The phenomenon was characterized by insufficient rainfall and high temperatures. Even as the demand for coffee declined due to the coronavirus pandemic, the unfavourable weather in South America supported the prices.

Another phase when weather conditions influence coffee price is during harvesting. During the berry-ripening and picking stages, rainfall should have subsided and the temperatures risen.

Heavy rainfall tends to delay harvesting; an aspect that lowers the commodity’s supply and results in higher prices.

Such a situation was observable in Brazil at the beginning of 2021.

Consumer demand

As aforementioned, coffee is one of the popular drinks in the world. In addition to consuming it at home, customers frequent restaurants, coffee shops, and hotels to enjoy the beverage. When less patrons visit such establishments, the demand for coffee beans drops and pulls prices down with it.

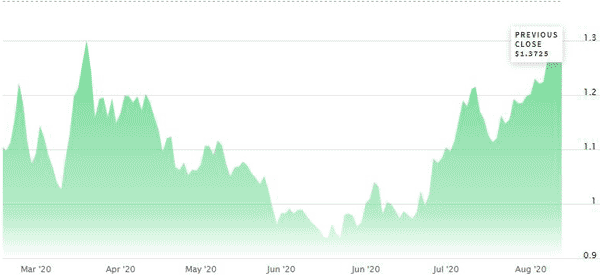

2020 is the perfect example of how consumer demand affects prices. After the WHO labelled coronavirus as a global health pandemic, countries used lockdowns and the stay-at-home approach to handle the situation.

In mid-March, the soft commodity was trading at a 3-month high of about $130.60. By the beginning of June, its prices had dropped to around $94.50.

Currency strength

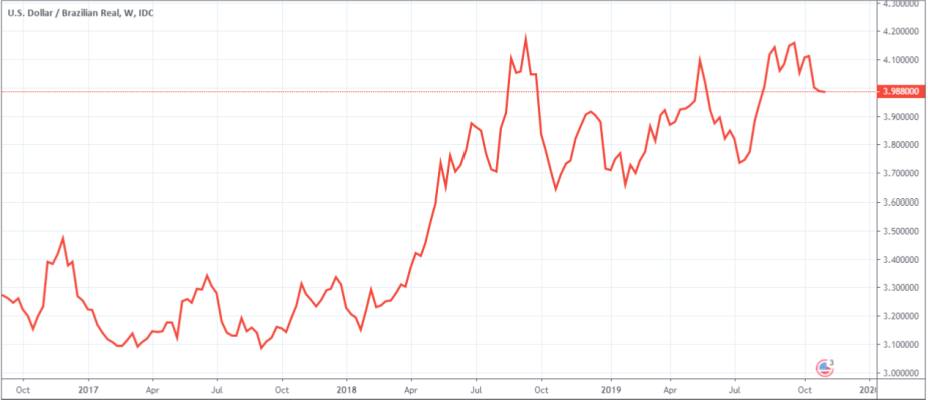

By now, we have ascertained that Brazil is the largest producer of coffee in the world. It is also important to note that commodities are mostly priced in the US dollars. As such, when the Brazilian Real is stronger in relation to the greenback, buyers are able to purchase a larger quantity of the commodity.

Traders who are looking to trade coffee often focus on data that is likely to alter the price of the dollar. For instance, bearish unemployment data may cause the dollar to weak. This will create a favorable environment for the rallying of coffee prices.

The reverse is also true: a strong US dollar often results in the decline of commodity prices.

» Currency correlations in trading

The decline of Coffee Beans Price

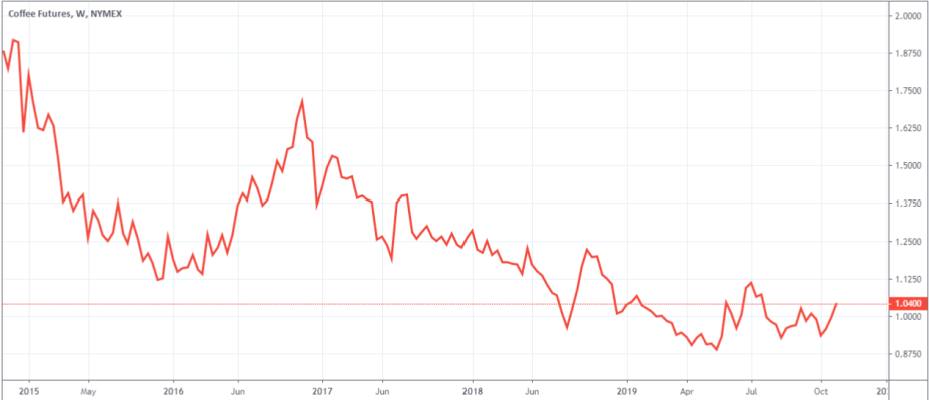

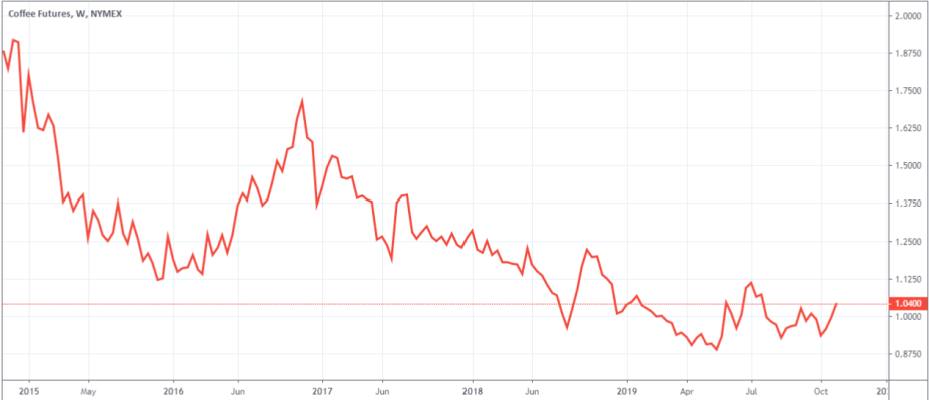

The price has been trading in a bearish pattern since November 2016, when the price reached a high of $1.80 per pound. In 2011, the commodity was trading at $3.0625 per pound. This trend is shown on the chart below.

There are several reasons for this decline.

First, the coffee market has been going through increased oversupply. The main producer of the crop are Brazil and Vietnam. As Economics 101 states, increased oversupply leads to lower prices.

This oversupply has happened as the number of acreage in Brazil continue to increase. Unlike the crude oil industry, this market does not have a central organization like OPEC to regulate prices.

As such, countries produce as much as they can.

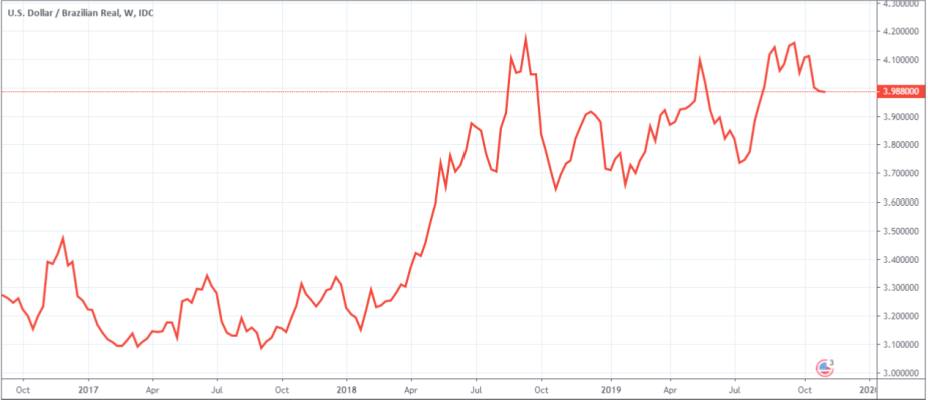

Another reason why prices have declined is the Brazilian Real. The currency has been on a downward trend against the US dollar as shown on the chart below. A depreciating real is usually negative to the price of coffee beans.

Four ways for a successful coffee trading

There are several ways to trade the the most traded commodity in the world profitably.

Coffee bean

First, you can trade beans themselves. These beans are listed in various futures exchange in London, United States, and Shanghai. As a result, they are offered by various online brokers (we have this too).

Currencies

Second, you can trade coffee currencies. The most obvious of these is the Brazilian real, which you can find in most online brokers. However, since coffee is a minor part of the Brazilian vast economy, the reality is that it is usually a bit diluted.

ETF’s

Third, you can trade coffee exchange traded funds (ETFs). These are large funds that are created with focus on this market. Some of the good examples of these ETFs are iPath Dow Jones-UBS Coffee ETN and iPath Pure Beta Coffee ETN among others.

Stocks

Finally, you can trade stocks of companies like Dunkin Brands, Starbucks, and Luckin Coffee.

Key Takeaway

To trade coffee well, you need to have the fundamental knowledge of the commodity. This means that you need to have a good understanding of the supply and demand dynamics of the crop.

As such, you need to know whether these countries are increasing or reducing production.

You also need to have knowledge on the weather conditions. Also, you need to have a good understanding of technical analysis. This is the practice of using indicators like moving averages, Relative Strength Index, and Stochastic Oscillator.

External Useful Resources

- Investing in the World’s 2nd Most Traded Commodity – Commodity.com

- Latest news about it- Dailycoffeenews.com

- Coffee Price Forecast – Walletinvestor