In the currency market, the GBP/USD pair – also known as the cable – is the third most traded pair after EUR/USD and USD/JPY.

There are a number of reasons behind this:

- Britain and United States are some of the oldest modern economies in the world.

- The two countries represent a large extent of safety which is very important among the investors.

- There is a lot of liquidity and volatility in the pair. Abundant liquidity makes it possible for traders to enter and exit the market with ease.

- Getting information on the two countries is relatively easy compared to other countries such as China.

In this article, We will highlight four key tips that will help you make better trades with this pair.

Before this, we will answer one of the most common question about Trading Currencies.

Why is it known as the cable?

It is known as the cable because of first transatlantic cable that was laid from the United States to UK for communication purposes (under the Atlantic Ocean, in 1858). Currency quotes were some of the key pieces of information transmitted through the system.

Understand the Two Economies

To be successfully in Trading Currencies, especially with The Cable, the most important thing you need to do is to understand the two economies and how they work. Without a detailed understanding of how the US and the UK economy work, you will not be able to make proper trading decisions.

How the two countries trade? Which is their trade balance? How the two countries relate with the outside world? Which is their monetary and fiscal policy, and their politics? These are some of the key point you have to focus on.

We give you the first topic: The United States is the main destination for United Kingdom’s products which include: cars, medical supplies and turbines among others.

Trading Hours

When trading the GBP-USD pair, timing is very important. There are two times when the volumes of the trade are optimum: This happens at the intersection of the European and Asian markets (3 am and 4 am EDT), and the intersection between the European and the American markets. Most orders are placed during this time.

Traditionally, the Asian session is marred with low volatility.

Major breakouts happen after the European markets open. In addition, major economic data affecting the two currencies is released during the European and American sessions.

› Opportunities when Trading Multiple Time Frames

Best time to trade GBPUSD

Therefore, the best time to day trade the GBP/USD is usually during the European session when the UK releases most of its economic data. Volume and volatility then increase during the American session.

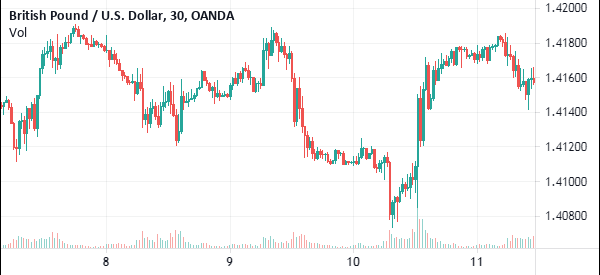

There is usually a lot of volume during the early session of the American period because that is when most economic numbers are released. The 30-minute chart below (in London hours) shows how volume increases during the European and American hours.

Understand the politics

United States and United Kingdom have similar political behaviors (they are open democratic countries). They are also part of similar political and economic blocks such as the NATO, OECD, and G20.

To be successful in trading this pair, it is very important to understand the dynamics of these affiliations affect the currency movements. For instance, when there is a G20 or G10 meeting, you should understand how the discussions will impact the currency pairs.

Also, with referendum that determined if the UK will remain part of the Euro or not. Or, again, when we are nearing the United States polls. You should understand how the pairs will move when either candidates gets the ticket.

Related » Why the GBP is stronger than the USD?

Fundamentals that move the GBP/USD

There are several fundamental factors that are important to look at when you are day trading the GBP/USD pair. Some of these are:

- Federal Reserve – The GBP/USD tends to move when the Fed makes its decision or when its members talk.

- Bank of England – The pair moves when the BOE makes its decision or when its leaders talk,

- Inflation – The UK and US inflation numbers move the GBP/USD pair because inflation has an impact on interest rates.

- Employment data – The UK and US employment numbers have an impact on the GBP/USD because they influence interest rates.

Other factors that impact the GBP/USD are politics, geopolitical events, retail sales, and industrial production.

Correlation and Technical Analysis

GBP-USD is one of the best pairs to trade with using technical analysis. Ordinarily, most technical traders prefer to use the pair because of the way it responds to key indicators.

Correlation is another reason why many traders use this pair. Correlation analysis is an important tool to determine which pairs to trade with based on their movements.

GBP-USD and EUR-USD

For instance, the correlational co-efficient of GBP-USD and EUR-USD is usually close to 1. This means that the pairs move almost in a similar manner because of the similarities in the base currencies.

For example, if GBP-USD moves up, chances of EUR-USD moving up are high. Therefore, it is easy to hedge the two pairs and minimize the risks involved.

External useful Resources

- Read the Top 7 Question about Trading Currencies on Investopedia

- Is Currency Trading Worth the Risk? Find it on WSJ