Gold. A shiny metal that only a very few people understand. The question among many traders, investors, and speculators alike is what gold is.

Is it a currency? Is it a commodity? In many instances, gold is placed in the precious metals category of your favorite platform.

But, again, is gold a commodity?

If it is, what is the mass appeal for gold? Which product – apart from ornaments – are made from gold? Why is it so valuable? Why does the American government have a lot of gold reserves?

Just consider this: if you are reading this post from your smartphone, you have a very small piece of gold in your hand (the same is true for desktop and laptop).

Thing is, gold is neither a commodity or a currency. Gold is insurance

Think about this, if you have $1000 today and decide to keep it in your house. In the next five years, you will have the same $1,000 but its value will be much lower. The items you will buy with the $1000 then will be fewer than what you will buy today. Its called time value of money.

What about gold? If you own an ounce of gold today, five years to come, you will have the same ounce of gold. What will have changed is the dollar price of gold.

Since the end of the gold standard, many people have talked about gold being a valueless commodity. They point the issues we pointed above. However, their thinking is wrong because it ignores the historic background of gold.

In the ancient times, gold was the main means of exchange in many countries. As a result of the bulky nature of gold, the countries decided to move to money because of the ease of printing it.

Today, most governments have vaults of gold. The US’ Fort Knox building holds gold worth more than $180 billion. In total, the treasury has gold reserves worth $11 trillion. Different countries have large amounts of gold.

Now it is time to answer the main question of our article. Why should a trader be interested in the blond metal?

How to invest in gold

A common question among many new investors is on how to invest in gold. Fortunately, there are several approaches to this, including:

- Gold CFD – A CFD is a financial derivative that tracks the price of an asset. Since it is a contract between a buyer and a broker, you can also decide to short it. With a short trade, you can make money as the price drops.

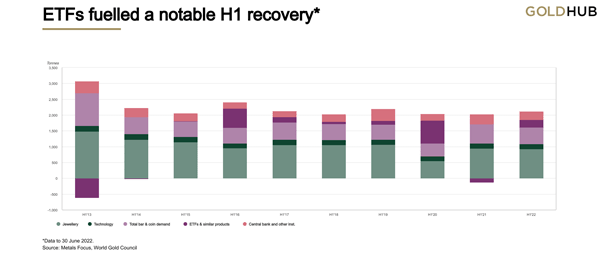

- Gold ETFs – You can invest in ETFs that track gold. The benefit of trading or investing in ETFs is that they operate as stocks and can be bought in any brokers.

- Gold stocks – You can also invest in gold indirectly by buying gold mining stocks. However, the correlation between gold and these companies is not always clear.

- Gold futures and options – These are financial derivatives that give you a right and not an obligation to buy an asset.

Some good reasons to have gold

#1 – Diversification

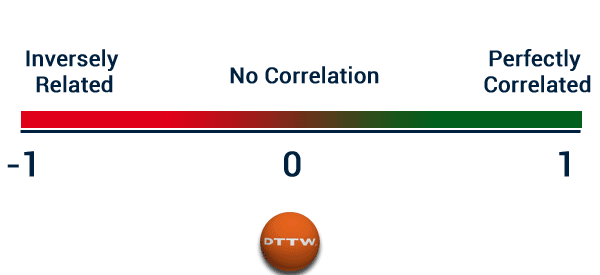

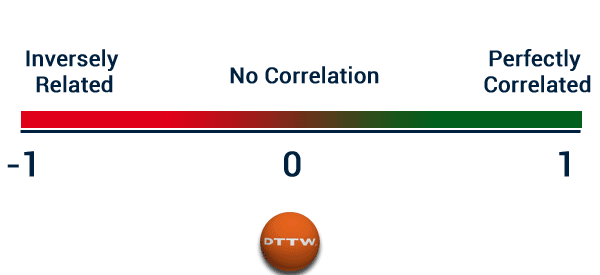

One of the most common laws of trading is diversification. The best way to diversify is to find instruments that have an inverse relationship with one another. Then, you should short and long these instruments.

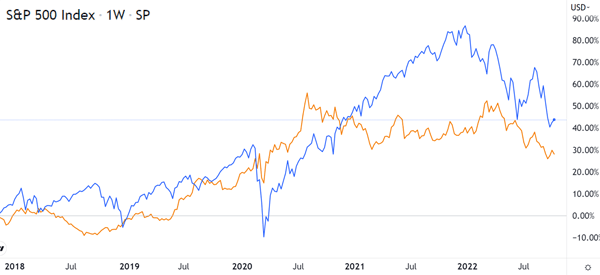

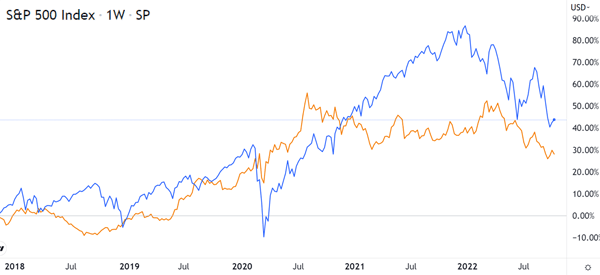

Historically, gold has had an inverse relationship with stocks and the dollar. In the 70s, after Brenton Woods was a positive for gold and negative for stocks. In 80s, it was a terrible period for gold and a fantastic economy for stocks.

In 2008, stocks fell while gold went up as investors moved to safety. In the same way, in 2015, the dollar strengthened against major currencies and gold went down.

Therefore, having gold in your portfolio will be a hedge against major market movements. However, in the past few years, gold and stocks have been correlated. In most cases, gold falls when stocks fall and vice versa.

#2 – Increasing Demand

As a country’s economic growth rises, the demand for gold grows. This is because more people will buy gold-made items such as ornaments and furnishings.

The global economy is growing, though at a slower-than-expected rate. But its growing. This growth is leading to more demand for gold which has played a role in the recent bullish trend.

There is a high chance that many central banks will embrace gold as a currency reserve following Russia’s invasion of Ukraine. In the aftermath of that invasion, the US decided to put sanctions on Russia’s Central Bank and withhold its reserves.

Therefore, analysts believe that more banks will move to alternative assets, including gold.

#3 – Supply Problems

The law of demand and supply states that an increase in supply leads to higher prices. The demand is rising while the supply is reducing.

In South Africa, labor problems are common which threaten the supply of gold. Statistics indicate that gold production fell from 2,573 metric tons in 2000 to 2,444 in 2007.

2015 was a tough year for commodities as their prices fell with many miners such as AngloGold reporting losses. Therefore, with reduced production, chances are that gold prices will keep on going up.

#4 – Geopolitical Uncertainty

Gold unlike other commodities are rarely affected by geopolitical issues. For instance, when there is a crisis in the Middle-East, chances are that the price of crude oil will go up. This is because oil is a ‘mass’ commodity.

On the other hand, gold is not a mass market product. Gold is known as a crisis commodity because in times of massive global tensions, investors tend to flock to it.

This makes gold an important hedging tool against major global geopolitical issues.

#5 – Inflation Hedge

Gold is the best tool to hedge against major global financial issues. One of these issues is inflation. This is because the price of gold tends to go up when inflation goes up.

Since the end of World War 2, inflation was highest in the following years: 1946, ’74, ’75,79, and ’80. During these years, the returns at the Dow Jones were about 12.3% compared to gold’s return of 130.4%.

Gold is also an important hedge against a weakening American economy because it tends to rise when the economy is not doing well.

How much of your portfolio should you invest in gold?

A common question is on the overall percentage of your portfolio that should go to gold investments. In creating a balanced portfolio, we recommend that you divide it into several key assets.

The most popular approach is known as 60/40. In this, you invest 40% of your funds in bonds and 60% of the rest in stocks.

The 60/40 approach is not always optimal. Instead, we recommend that you should allocate about 80% of your funds in a group of balanced stocks. This should include both value and growth stocks. The next part of the portfolio should go to other types of assets, including bonds, commodities, and some cryptocurrencies.

In this regard, you can allocate about 10% of your portfolio to gold. You don’t want to be too much exposed to gold or any one asset in particular.

Summary: what to do as a day trader?

For day traders, We recommend that you take time to understand how to trade gold and how gold moves on an intraday basis.

Understanding gold behavior is not as easy as We have explained in this article. In fact, it takes a lot of skills to effectively trade the commodity. By reading books and watching videos, you will learn how to conduct correlation tests and make better decisions.

External useful resources

- Pros and Cons of Having Gold in Your Portfolio – The Balance