In the fast-paced world of finance, where market fluctuations can occur with lightning speed, mechanisms are in place to maintain stability and protect investors.

In a previous article, we explored the concept of circuit breakers, which serve as vital tools in the financial market. These circuit breakers are triggered when the price of an index experiences a significant decline, providing a temporary respite to market participants and helping to alleviate panic.

However, alongside circuit breakers, another crucial aspect that plays a pivotal role in ensuring market order is trading halts. These strategic pauses in trading activities, imposed by regulatory bodies or exchanges, serve a distinct purpose in preserving the integrity and efficiency of the financial system.

In this comprehensive report, we will delve into the intricacies of trading halts, examining their fundamental principles, objectives, and the impact they have on various market participants.

By gaining a deeper understanding of these essential mechanisms, we can navigate the dynamic landscape of the financial market with greater insight and confidence

What is a trading halt?

A trading halt is when a financial asset is paused by the exchange for several minutes or hours. During this period, no market participants can buy or sell the asset. The halt can happen for stocks, indices, and commodities in some cases.

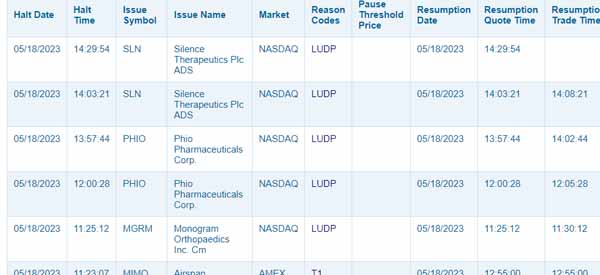

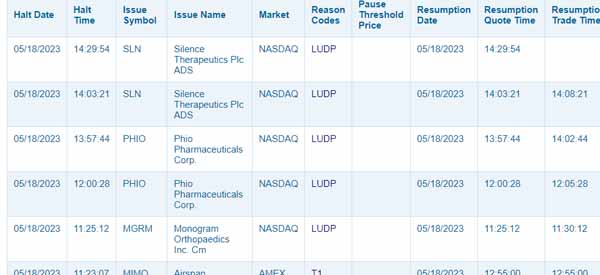

For example, a stock can be halted if it drops by a certain percentage in an asset. This halt helps to give traders with a breather about the situation. The chart below shows some of the most recent halts.

How trading halts work

In the United States, there are two main exchanges: NASDAQ and New York Stock Exchange (NYSE). These exchanges have their own requirements for halts but to a large extent, they tend to be the same. Further, the Securities and Exchange Commission (SEC) has its own halts.

Therefore, when these conditions happen, the exchanges halts the stocks based on the key challenges. For example, an exchange like NASDAQ can halt a stock from being traded if there is a major issue such as upcoming announcement.

Top reasons for halts

There are several reasons why halts happen. The Nasdaq has created a comprehensive list of the items that lead to these halts. These include:

- News pending – A good example of this is what happened in Hong Kong. Other news could be an investigation into a company and mergers and acquisitions.

- Volatility – This is a halt that happens when the price of an asset falls by more than 10%.

- Extraordinary activity – This happens when there is an extraordinary activity in a company.

- Non-compliance – This halt happens when a company does not comply to listing requirements.

- Non-current – This happens when a company misses to submit the required regulatory information.

Other reasons why halts happen are: Corporate actions, regulatory concerns and when there is a technology issue.

Benefits of trading halts

Trading halts happen with the goal of creating an equal playing field in the financial market. They also happen to ensure that market participants internalise and digest the information before buying or selling.

A circuit breaker, which is a form of a trading halt is essential because it prevents retail and unsophisticated traders from overreacting.

Cons of trading halts

There are several cons of trading halts in the market:

- It prevents traders from exiting profitable trades. For example, if you are short a stock, then the a halt will prevent you from exiting.

- It can lead to volatility in a stock.

- A stock halt can lead to delisting the stock. For example, if a stock stays below $1 for a while, it can lead to total losses.

What to do when a stock is halted

In most times, trading halts happen before the market opens. This means that it is not possible to buy and sell stocks.

Check the Stock

When you find that a stock is not trading, a good thing to do is to check whether the stock has indeed been halted. For companies listed in Nasdaq, you can check this page to see the reason for the halt.

If a halt happens in a stock that you have already bought or sold short, it means that you are in a difficult situation. This is because the stock will likely see some volatility when the stock starts to trade again.

The Reason

The second thing you need to do is to know the reason for the halt. In the case of Swire Pacific, the stock jumped after the bailout as you can see below. Still, the stock then dropped in the following days.

Therefore, understanding the reason of the halt can help you make informed decision.

Halt Yourslef!

Finally, you should not panic or overreact when there is a trading halt. Doing the two could make you make uninformed decisions. For example, in the case of Swire, while the stock jumped after the news, it then dropped.

» Related: The Most Common Psychological Trading Mistakes

How long does a trading halt last?

As mentioned above, there are several types of trading halts that have different timelines. First, there is level 1 avatar that happens after the S&P 500 index crashes by 7% in a single session. This halt lasts for about 15 minutes.

The other type is level 2 and is a type of halt that happens when the S&P 500 drops by 13% in a day. This halt also lasts for 15 minutes. Finally, there is level 3 halt that happens when the index drops by 20%. It lasts for an entire day.

There are other types of halts in the market that have different periods. For example, there are halts pending news, non-compliance halts, corporate action, and new issue available. These halts don’t have a set timeline.

FAQs about trading halts

Are trading halts good?

What happens when a trade is halted?

Who decides to halt trading?

Brokers like Robinhood and Schwab don’t typically halt stocks. Still, they have the power to limit a stock from being traded. For example, during the Wall Street Bets boom, a company like Robinhood placed limits on trades.

Can you buy or short a stock during a halt?

How do you know when a stock is halted?

Final thoughts

Trading halts are essential components of the financial market. They help make the markets work by creating a level playing field.

As a trader, the knowledge that halts exist should make you always have a stop loss on all your trades. They should also incentivise you to avoid leaving your trades open overnight.