Inflation refers to a situation where the cost of products is rising. It is one of the worst situations in finance since it usually devalues the currency and in the long run, it makes most people poorer.

In this article, we will explain what inflation is, its causes, how it is calculated, and how to trade it.

What is inflation?

Inflation is a situation where the cost of living is increasing. For example, if the price of an item moves from $10 to $12 within a year, it means that its inflation has risen by 20%.

As such, before the jump, $1,000 would have bought you 100 pieces of the item. With inflation, the same amount of money will buy you 83.3 of the same item.

Inflation vs deflation

Another popular concept in economics is known as deflation. It refers to a situation where the price of items is falling. As such, if an item’s price moves from $10 to $8, it means that your $1,000 will buy you more of the products.

Deflation sounds good to many people. However, for economists, it usually sends the wrong message. It usually implies that there is no major demand for an item. As such, it can be a sign that the economy is not growing as fast.

Inflation vs stagflation

Inflation and stagflation are related concepts that policymakers tend to look closely. Stagflation is usually a period when high inflation coincides with a period of low economic growth.

In this period, it usually means that wages are growing at a substantially slower pace than inflation. It is one of the worst scenarios that policymakers face on a daily basis.

How to calculate inflation rate

Inflation data is usually provided by statistics agencies of countries. In the United States, it is calculated by the Bureau of Labor Statistics.

Ideally, the agency usually has a basket of key items that people buy. It then tracks the movement of prices every month and comes up with the real inflation rate. The most popular inflation numbers are:

- Consumer Price Index (CPI) – This refers to the overall change of price movements in the entire economy.

- Producer price index (PPI) – This data refers to the changes of prices of key products that producers buy (we mentioned it in our post about economic calendar).

- Personal consumer expenditure (PCE) – This is the most important inflation data that is followed by the Federal Reserve. It looks at changes of expenditure by consumers.

What causes inflation?

The simplest way to explain the cause of inflation is that it happens when there is too much money chasing a few goods.

When this happens, the prices of items will always go up dramatically. For example, assume that there is a community of 1,000 people. Then, someone comes and gives them $1 million each.

The outcome of this situation is that the cost of living will go up automatically. Besides, sellers already know that the residents are loaded.

Central banks

The central bank is one of the biggest causes of inflation since it is the only agency that has the role of printing money in an economy. Therefore, a dramatic increase of money supply usually leads to high inflation.

Related » How monetary policy works

For example, in 2022, inflation surged because of actions of the Fed to increase money supply through its quantitative easing (QE) policy.

Geopolitical

Second, geopolitical events can lead to high inflation. For example, the war in Russia led to sanctions against the country. As a result, the flows of energy were imprerilled because of the significant role that Russia plays in the world.

Phillips curve

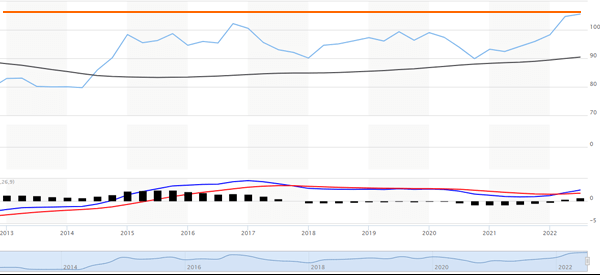

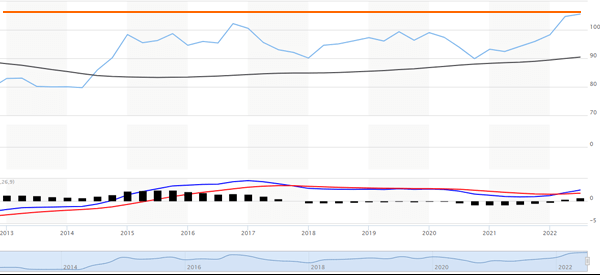

Third, there is the concept of the Philips Curve. In economics, this concept says that inflation will rise when the unemployment rate falls. While the concept is correct, some countries like Japan and Switzerland have defied them.

Impact for traders

Inflation has a direct impact for traders. This impact happens primarily since high inflation usually leads to interventions by central banks. The most common intervention tools are interest rates and quantitative tightening.

Inflation in forex

Inflation has in impact in the forex market. When it rises, the Fed usually boosts interest rates and ends quantitative easing policies. As a result, the US dollar tends to rise dramatically when the Fed tightens. For example, in 2022, the dollar index jumped to a 20-year high as the Fed hiked interest rates.

On the other hand, a stronger US dollar usually leads to turmoil in emerging market and developing countries. Besides, these countries usually have a lot of dollar-denominated bonds that they need to service.

Inflation in stocks

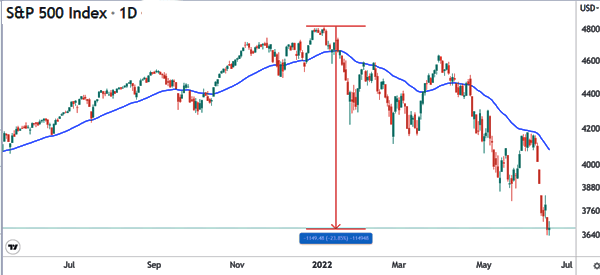

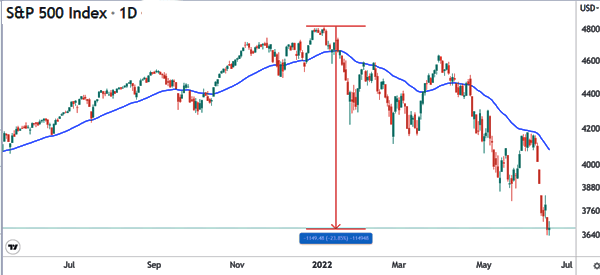

High inflation tends to hurt the performance of stocks because of the extremely hawkish central bank. Historically, stocks usually thrive in a period of low interest rates and then suffer whe the Fed is hiking. For example, American stock sunk to a bear market in 2022 when the Fed embraced a highly hawkish tone.

Inflation also has an impac in the commodities, cryptocurrencies, and bond market. Commodity prices tend to rise and then fall during a period of high inflation.

They usually fall because of demand destruction, which happens when high price remove the incentive for more purchases. For example, high fuel prices can push people from making trips.

How to protect against inflation

Hedging against inflation is a relatively difficult situation. In periods of high inflation, even the best-known inflation hedges usually underperform.

The best hedge against inflation is known as Treasury Inflation-Protected Securities (TIPS). These are bonds whose returns track the performance of the CPI. As such, their returns usually rises when there is inflation and fall when there is deflation.

Still, the main challenge of TIPS is that it tracks the CPI, an index that that is not a real measure of inflation.

Other popular hedges against inflation are gold, the US dollar, and stocks. However, in the 2022, all these assets failed in their roles as inflation hedges. In the long run, stocks and gold have performed better than inflation.

Summary

In this article, we have looked at the concept of inflation and how it works. We have also assessed the differences between inflation, stagflation, and deflation.

Most importantly, we have noted the best ways to protect yourself against inflation. As a trader, this period usually leads to more market volatility, which can be a good thing for day traders.

External useful resources

- How to Hedge Against Inflation – Admiral Markets