News and earnings data are among the most important movers for stocks. On news, stocks tend to move because of overall market news like mergers and acquisitions (M&A), political news, or specific company-related events.

On earnings, stocks usually move when a company releases its quarterly earnings results. In most cases, the stock will do well when a company reports better results and gives an upbeat forward guidance. Similarly, market activity after an IPO is usually a major mover in the market.

In this article, we will look at how to trade on the following day after the news. In these cases, making the best use of the economic calendar is essential!

Two main outcomes

Ideally, there are two main outcomes after the stock rises or falls after a major announcement.

First, the stock can attempt to fill the gap. If it gapped upwards, sellers may attempt to push the price lower. Second, the price may continue rising. A good example of the two scenarios is shown in the chart below.

In the first situation, sellers continued to push the stock lower while in the second scenario, they attempted to fill the gap.

Therefore, when the stock gaps up, it does not mean that the trend will continue in that direction. Indeed, this is a major mistake that people make.

After a major event, which leads to a gap, the financial asset will attempt to fill that gap. This happens as traders attempt to buy the dip, in case of a major dive. On the other hand, it can retreat in case of bullish dive.

Alternatively, depending on the news, the asset can do a continuation pattern, where they continue in the gap direction. That continuation will depend on the news and the follow-through event.

Finally, the asset can consolidate due to indecision among market participants

Identify key technical levels

Another important item to understand on the second day is about key technical levels. Whenever a stock gaps up or down, the levels it lands are often not by accident. Instead, they are essential technical levels.

A good way to identify these technical levels is to change the time of the chart’s time.

For example, if you are using the daily chart, you can shift it to the weekly chart and note the relevance of these psychological levels.

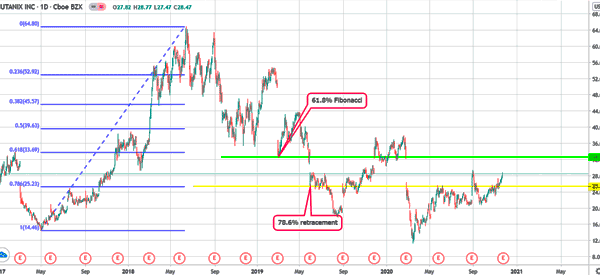

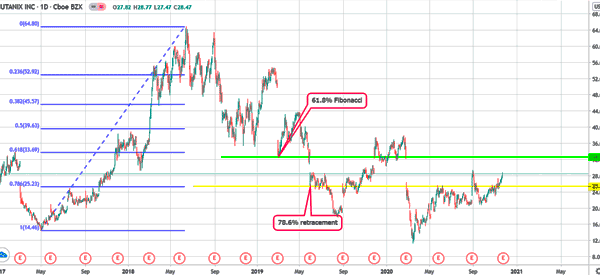

On the weekly chart below, we see that Nutanix stock landed on the 61.8% Fibonacci retracement level when it declined first. On the second major down gap, it moved to the 78.6% retracement levels.

In a down-gap, if it fails to move below the retracement level, it means that the price will attempt to move back up again. On the other hand, if it manages to move below the support, it means that there will be a continuation of the gap, as shown below.

Check for key support and resistance levels

Another important aspect to look at is on identifying the key support and resistance levels. A support is a level where the price fails to move below while a resistance acts as a ceiling for the stock.

In most cases, identifying the two levels can help you know when to enter a long or short trade.

Let’s look at the example of Palantir Technologies, a company that went public recently.

Example: Palantir Tech

On its IPO day, the stock opened sharply higher and reached a high of $11. After that, the stock started falling and ultimately reached a low of $8.94. It then attempted to bounce back and ultimately, it established a triple bottom pattern at $8.94.

Since then, the stock has been on an overall upward trend. Indeed, a double or triple top pattern is usually a sign that the asset will reverse.

Strategies to have higher returns after a key event

There are several tips to ensure that you have higher returns a day after a major corporate event. Let’s Dive into some of these tips.

Don’t leave your trades open overnight

As a day trader, you should avoid leaving your trade open overnight. As mentioned above, a stock can do several things after a major event, including a continuation or a reversal.

As such, to avoid being caught up in these, ensure that you have closed your trades before you end the day.

Have a stop-loss and a take-profit

Ensure that you have a stop-loss and a take-profit for all your trades. A stop-loss will automatically stop your trade when losses reach a certain level.

On the other hand, a take-profit will stop your trade once it reaches a certain profitability level. Having the two stops will help you avoid making substantial losses.

Look at the flow of volume

Always look at the flow of volume after a major event will help you predict whether an asset’s price will have a reversal or not.

Many brokers provide tools to analyze an asset’s volume. We also recommend that you use time and sales and level 2 tools to conduct this analysis.

Take time before you enter a trade

A common mistake that people do is to be in a hurry when entering trades after a major event. In most cases, they will place a buy trade when they see a stock rising in the premarket.

Alternatively, they will open a sell trade when they see a stock crashing after a major event. In most cases, these trades, which are opened in hurry tend to lead to losses.

Related » Confirmation checklist before placing a trade

Summary

Special situations like IPOs and earnings are the most eventful periods in day traders. Experienced traders make most of their money in such periods. However, most inexperienced traders tend to lose most of their money during these special situations.

Therefore, using some of the strategies mentioned here can help you avoid making mistakes like continuing to short when the price makes a double bottom.