The open and close are the most important periods in the stock market. The open is important because it is the time when most traders are rushing to buy or sell their holdings.

For example, if a company released its earnings in the aftermarket, many traders will move to react to the news when the market opens.

Similarly, the closing time is important because most traders rush to sell their holdings because most of them are afraid of holding their stocks overnight.

In this report, we will look at the best strategy to trade the open in stock market.

What is the open?

The open refers to a period when the stock market opens after being closed in the overnight session. It is usually at the intersection of the pre-market session and the regular period.

In the United States, the market opens at 9:30 AM, Monday to Friday.

Why the open matters

The open is an important part of the market because it usually sees the biggest amount of volume. This happens because most people tend to trade in the first hour when the market opens.

Additionally, high-frequency traders usually execute trades opened in extended hours when the market opens. Therefore, if you want to catch opportunities earlier, market open is an ideal time to do so.

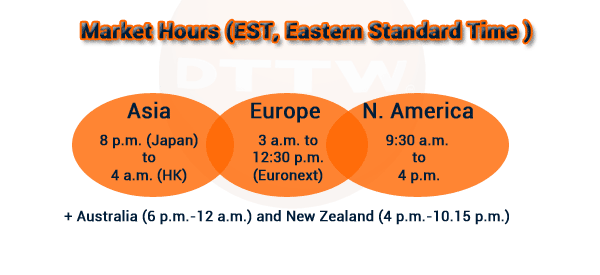

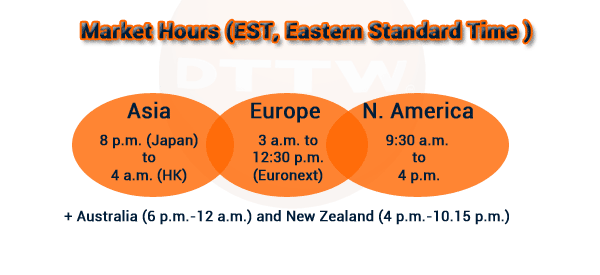

Another important aspect about the market is that it is usually at the intersection of European and American market hours.

What you need to trade the open

Having a watchlist

We already looked at the important concept of having a watchlist in the market. In its simplest form, a watchlist is a document that shows you the most important companies of the day.

At Real Trading, we send our customers a watchlist that shows all companies that are moving and the reasons why they are moving. Therefore, when trading the open, we recommend that you have this watchlist because it will give you more details about key market movers.

Related » How to Get the Most Out of Your Daily Stock Watchlist

Trading Platforms

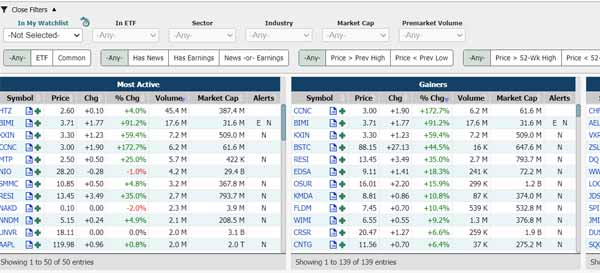

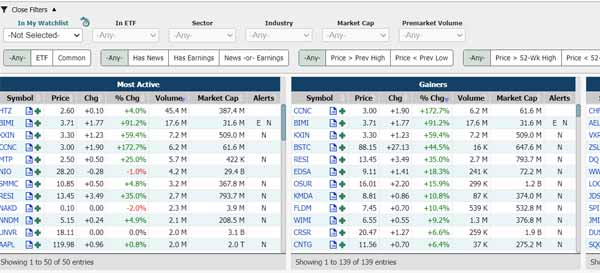

In addition to having a watchlist, we recommend that you use several free platforms to identify stocks that are making action in the pre-market session.

In this, you can identify stocks that are either soaring or crashing in the premarket period. Further, you can look at stocks that are nearing their 52-week high or low.

Most importantly, you should consider stocks that have just released their earnings or those that are scheduled to publish them.

Another approach is to use some popular trading platforms that look at the most active stocks in premarket trading. Some of these platforms are Market Chameleon, Investing.com, and Webull.

By looking at these platforms, you will be able to generate trade ideas by looking at the top gainers and looking at the reasons why they are moving. The screenshot below shows a sample page by Market Chameleon.

Tips to trade the open

Focus on one company

You may be tempted to trade several companies when the market opens. This is often the wrong thing to do because of the risks involved. Since the market tends to be volatile, focusing on several stocks can make you miss key opportunities.

On the other hand, taking time to trade a single stock during the open can help you identify opportunities and see how the stock trades in the first few minutes.

Trading Gaps

In most cases, gaps usually happen when the market opens. You can look at more information about how to trade morning gappers in our comprehensive report. In short, there are several strategies to trade these gaps.

Continuous Gap

First, there is a gap that happens and then continues. In this case, your goal is to buy and continue holding so long as the volume continues to support the price action. You can use level 2 data and time and sales information to trade these gaps.

Gap and Reverse

Second, there is a gap that happens and then the trade reverses. In this case, a stock can climb by more than 4% when the market opens and then ends lower.

A good option to do this is to short the stock at the top and make profit as it drops. This tends to happen when there is significant volume at the open that then fades.

For example, in the chart below, we see that the two morning gaps were later filled. Notice the volume in the two periods.

› How to Day Trade Reversal Patterns

Always protect your trades

Finally, another important aspect when trading the open is on the need to protect your trades. Ideally, because of the volatility involved, it is possible to make money and then see it wiped away. You can do this by ensuring that you don’t risk a lot of your money per trade.

Also, you should ensure that you have a stop loss or a trailing stop loss for all of your trades. In addition, another excellent strategy is to use stops and limits. This is where you direct the broker to buy or sell when the price reaches a certain level.

FAQ

Should you trade the open?

What should you look at?

What about other assets?

External Useful Resources

- Trading Strategies for the Opening Bell – Investors.com