Foreign Exchange, commonly known as forex, is a large industry that makes it possible for people to buy and sell currencies for a profit. It is the most liquid market in the world, with its daily trading volume being worth over $5 trillion.

This asset is very popular among those who decide to invest long-term and those who prefer to trade with shorter time frames, such as day traders or scalpers.

However, you are here for a reason: to understand how to succeed in generating profits by exchanging the currencies of different countries. You need to familiarize yourself with the concept of spreads in forex; it’s all about that.

In this article, we will look at how forex pairs are quoted and take a deep dive into the concept of spread.

What is a spread in forex?

Forex brokers don’t charge a commission for their services. Instead, they make money from the currency differentials that happen between the bid and ask prices. These spreads usually depend on the currency pair.

For highly liquid currency pairs like the EUR/USD and GBP/USD, the spread is usually significantly thin. And for highly illiquid pairs like TRY/SGD and GBP/BRL, the spread is usually wide since their demand is a bit low.

At times, providing forex trading services using a spread instead of a commission can be highly profitable for companies in the industry. In fact, many money transfer companies have shifted their business model to focus on the spread.

Types of spread in forex

There are basically two main types of spread in forex: fixed and variable.

Fixed spread is a situation where a broker ensures that the difference between the bid and spread is the same. In most cases, these spreads are offered by brokers that operate as a market maker or dealing desk.

A dealing desk is a situation where a broker buys a large position of a currency pair and then offers them in smaller sizes to traders. They simply act as a counterparty.

A variable spread is a situation where the spread of a currency pair changes with time. The spread widens when there is significant volatility and thins when there is limited volatility.

For example, the spread of the EUR/USD pair can be 2 in normal periods and then widen to 20 after a major event such as interest rate decision. The benefit of variable spreads is that they eliminate requotes and are more transparent.

How the spread is calculated in forex

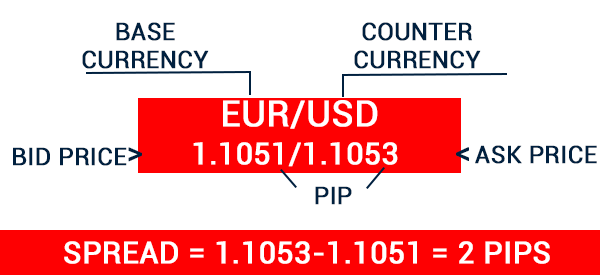

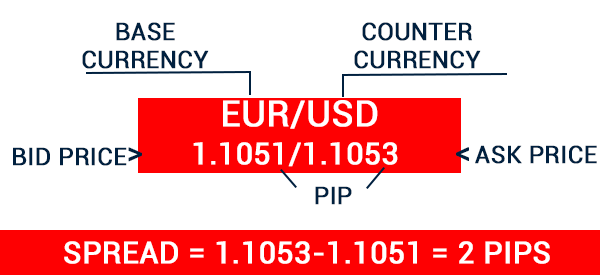

The spread of a currency pair is calculated by subtracting the bid from the ask price. Let’s look at an example, where the EUR/USD pair is trading at 1.1050/1.1055. In this case, the spread of the pair is calculated as 1.1055 – 1.1050, giving it a spread of 5 pips.

Some currency pairs like the USD/JPY pair are quoted differently. The USD/JPY pair can be quoted as 111.15/111.20. In this case, the spread of the pair will be 5 pips.

How currencies are quoted in forex

The concept of currencies in forex trading is a relatively simple one since it involves buying and selling currencies. Indeed, we can argue that everyone with cash is a forex trader because holding one currency over the other is a sign that they believe that their currency will gain value.

For example, if you hold US dollars in your account, you simply believe that the value of the USD will continue rising.

Currencies are quoted in pairs since you need to exchange one currency for another. Examples of currency pairs are EUR/USD, GBP/USD, and EUR/GBP. In this case, the first currency is known as the base currency while the second one is known as the quote currency.

As such, if the EUR/USD pair is trading at 1.1025, it means that one euro is equivalent to 1.1025 US dollars. As such, it means that one USD is more valuable than the euro.

For most developed country currencies, pairs are easily quoted. In this case, the official exchange rate is almost the same one that you will exchange currencies with. However, in many developing and emerging markets, these official exchange rate is usually different from what people get in the market.

Forex pairs have two main prices, which are known as bid and ask. Bid is the maximum price that a buyer is willing to pay while ask is the maximum that a seller is willing to pay.

Bid is usually in the left side while ask is in the right side of a currency quote. A good example of this is shown below.

Factors that affect a currency spread

There are three factors that affect the spread of a currency pair, including:

Market volatility

For variable spreads, market volatility plays an important role in spreads. In most periods, brokers will often adjust the spread to reflect the volatility of the market.

Good brokers tend to provide a warning before adjusting the spread.

Currency pair liquidity

Liquidity is an important factor that determines spread of a currency pair. Highly liquid pairs like the EUR/USD and GBP/USD tends to have an extremely thin spread.

On the other hand, pairs like the GBP/TRY and EUR/BRL have wider spreads.

Market news

The other important factor that affects spread of a currency pair is market news. In most periods, currency pair spreads tend to be wide when there are substantial market news.

For example, some of the most popular market news are on the Federal Reserve and political news.

Related » How to do news trading

How to choose low-spread pairs

Forex experts recommend selecting low-spread currency pairs instead of those with wide spreads. These pairs are usually easy to enter and exit.

Some of the most popular currency pairs with the smallest market spreads are the EUR/USD, USD/JPY, and GBP/USD.

Forex minors like the EUR/GBP, AUD/GBP, and AUD/JPY have wider spreads. Exotic currency pairs like GBP/TRY and EUR/PLK have extremely wider spreads.

Summary

In this article, we have looked at the concept of spreads and how it works. We have also assessed how these spreads are calculated and the top factors that affect them.

In some cases, especially when you have high degree of confidence, it makes sense to trade pairs that have wider spreads. However, in most cases, wer recommend focusing on highly liquid currency pairs.

External useful resources

- How Does Spread Affect Profit in Forex? – Broker Explorer