Macroeconomics is a field of economics that focuses on large-scale things that affect the national or international economy. Broadly, it involves things like interest rates, inflation, jobs numbers, international trade, and labor productivity

The opposite of macroeconomics is known as microeconomics, which focuses on smaller scale parts of the economy.

Some of the top components of microeconomics are demand and supply, incentives, and costs and benefits. In this article, we will look at how to conduct macroeconomic analysis in day trading.

Why does macroeconomic analysis matter to traders?

In most cases, many day traders don’t pay a focus on macroeconomics. Instead, these traders focus on technical analysis, where they identify patterns and then execute trades. Still, many traders, especially in the forex and commodities market tend to use this data to execute swing trades.

Stock traders can also use macroeconomic data to predict the next Fed decisions and then position accordingly. If the US publishes strong numbers, it means that the Fed could hike interest rates, which will have an impact on stocks.

Therefore, macroeconomics matter to traders because they provide the bigger picture about the market and the economy. As a result, they help traders understand how to position themselves.

Also, some macro data can lead to immediate impact on assets. For example, rate hikes by the Fed will always have an impact on the US dollar.

For instance, in 2020, economies across the world were struggling due to COVID-19. Customer spending was lower, unemployment levels were higher, and some businesses had to close shop. Subsequently, central banks and the governments acted by enacting policies meant to improve the situation.

In the US, the implemented measures included a quantitative easing (QE) program and lowering interest rates to near zero. It was a way of stimulating the economy back to its original glory.

How do you as a trader perfect the art of doing quality macroeconomic analysis?

Historical details

The first thing you need to do is to look at the bigger picture. In this, you should always start a macroeconomic analysis from the top.

For example, if you want to do a good analysis about the American economy, you should start by looking at the historical growth of the country. By looking at the historical data, you will be at a better place to understand the current happenings.

In this, you should consider reading books and opinions about the economy, its components, and the key challenges the country has faced.

Current economic situation

After reading the historical details, you should now consider looking at the country’s current economic situation. As a trader, the most important thing you need to know about, past the crisis is on how the federal reserve sees the market.

In this, you want to predict the pace of the normalization process. You can get a bigger picture by going to the website of the federal reserve and reading their comments and minutes from their meetings. By reading these minutes, you will be at a better place to understand how the officials think.

There are two main components of this: fiscal and monetary factors.

Fiscal policies are those that are typically made by politicians, including stimulus, government spending, and taxation. These factors tend to have major implications in the economy, with high taxes impacting growth.

Monetary policy, on the other hand, are factors that are caused by central banks. Central banks influence policies by hiking or lowering interest rates or by implementing quantitative easing (QE) and quantitative tightening (QT) policies.

Interest rates

In your analysis, everything should always lead to interest rates. To better understand this, analysts use what is known as the Phillips Curve.

The Phillips Curve gives a theory that explains the relationship of jobs and inflation. The theory says that inflation tends to go up when the unemployment rate falls. The idea is that when more people are employed, they tend to buy more leading to increased inflation.

On the other hand, when inflation rises, the central bank tends to raise interest rates to contain it. By raising rates, the country’s currency tends to strengthen as more people buy the currency for the yields.

Understand the economy of a country

As a trader, you need to do the best you can to know and understand the economy of the countries you are trading in.

For example, if you trade in the dollar, you need to have a good understanding about the American economy off the top of your head. You need to be prepared to answer a simple question about the unemployment rate of the country or the current inflation rate or the GDP growth.

The same should apply to all the countries that you deal with on a regular basis as a trader.

Related » 7 Types of Economic Data That Traders Should Always Monitor

Getting and mastering all this information is not difficult. Still, you should not put yourself under pressure to know everything within a short period of time. It will take time for you to grasp all this. The key is to have interest and follow all the news as it breaks.

Macroeconomic for traders

For traders, macroeconomic analysis helps in predicting price movements in different markets. For example, if one is keen on trading gold, newsworthy releases from the US will be of importance. This is because of the historical inverse relationship between precious metals and the greenback.

On the side of businesses, macroeconomic analysis is a crucial tool in evaluating or formulating their strategies for global and domestic markets.

For instance, if a country is undergoing an economic crisis, it may not be a suitable period for a multinational company to expand to the region.

Develop a compelling trading plan

The other thing you need to do is to develop a good trading plan when using macro-economic data. One way of doing this is to use the economic calendar to find trading opportunities.

For example, you can come up with a trading strategy where you enter and exit a trade ahead or after an important economic data or a central bank decision. In this case, you can place a bracket order ahead or after these events.

Example of macroeconomic analysis

To get a better understanding of macroeconomic analysis, let’s use the United States as our example. Indeed, it is impossible to analyze the global economy without considering this western nation.

With it being the largest economy in the world, it is an influential entity in geopolitical and economic matters alike.

If you intend to trade directly in the US dollar or indirectly via financial instruments impacted by the currency, you will need to evaluate the applicable macroeconomics entities. GDP and the inflation rate are also key elements in a macroeconomic analysis.

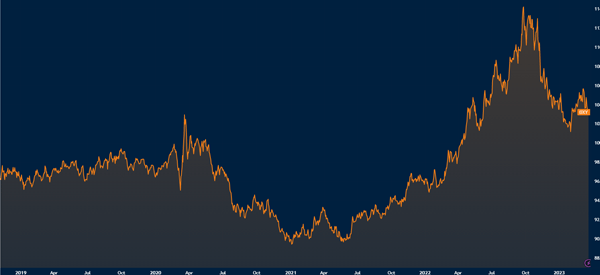

A good example of this is in the chart above. As seen, the US dollar index jumped sharply in 2022 as the Federal Reserve hiked interest rates from 0% in January to over 4%.

External Useful Resources

- What Is the Phillips Curve (and Why Has It Flattened)? – STLouisFed

- Macroeconomic monitoring and fiscal surveillance – European Commission