Financial markets go through several market conditions. At times, the market will remain in a tight range as investors struggle to find direction. In other periods, assets will continue moving in a bullish or bearish trend. At other times, assets will be relatively volatile, where they rise and fall significantly within a short period of time.

In this article, we will look at the concept of whipsaws in day trading.

What are whipsaws in trading?

A whipsaw is a saw with a narrow blade that is mostly used in the lumber industry. To produce timber, two people move the whipsaw up and down.

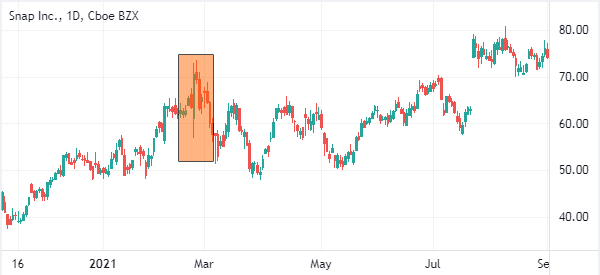

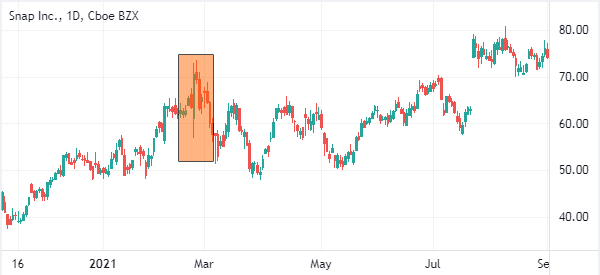

In the financial market, a whipsaw is defined as a period when a financial asset like a stock or commodity suddenly moves in the opposite direction abruptly. A good example of this is in the Snap chart below.

As you can see, the stock made a strong bullish jump and then started moving lower.

Causes of a whipsaw

There are a number of causes of whipsaws in the financial market. First, it can be caused because of a major news that breaks during a trading session. Some of the most common news events that causes whipsaws are earnings, federal investigations, and a major short report.

Second, a whipsaw can happen because of macro reasons. For example, it can be caused by a change in tone by the Federal Reserve. In most cases, if the Fed suddenly turns hawkish, investors can react by pushing a stock significantly lower.

Third, it can happen because of technical reasons. At times, a stock can decline sharply because it reached a key psychological level.

Key scenarios after a whipsaw happens

A whipsaw is a bit difficult to trade since it can only be seen once it happens. This is unlike other patterns such as a trending market. Therefore, most people tend to lose a significant amount of money when a whipsaw happens in the opposite direction.

There are three key scenarios that happen when a whispaw happens.

First, the asset price can continue moving in the direction of the whipsaw. For example, if an asset whose price is rising has a strong bearish whipsaw, the price could continue moving in a bearish trend. This is known as a reversal.

Second, an asset can have a whipsaw and then continue with the original direction. And finally, a whipsaw can happen and then the prices will remain in a narrow range.

How to trade whipsaws

As mentioned above, it is relatively difficult to trade whipsaws since they happen suddenly. Therefore, the only way to trade them is after the situation happened.

Know the reason

First, you need to know why the whipsaw happened. Fortunately, with the internet, you can find out easily why a stock gyrated. You can do that by simply doing a Google search. Alternatively, you can search the ticker of the stock in popular platforms to find out the cause.

The benefit of understanding why the whipsaw happened is that it will help you predict whether the stock will continue with the direction of the whipsaw or change it. This is important since investors tend to overreact when there is a major event.

Related » Risk Comes from Not Knowing What You’re Doing

Analyse different timeframes

Second, after identifying the reason, we recommend that you conduct a multi-timeframe analysis. This is a situation where you conduct an analysis on a stock in different periods in order to find key support and resistance levels. As a day trader, you can start this multi-timeframe analysis from the four-hour chart and then narrow it to the 15-minutes chart.

Use bracket orders

Third, one of the best approaches of trading during a whipsaw is to use a bracket order. This is an order where you place a buy and sell-stop and then protect it with a stop-loss and a take-profit. For example, assume that a stock is trading at $10 and then whipsaws to $7.

In this case, you can place a sell-stop at about $6.5 and a take-profit at $6. You can then add a buy-stop at $7.5 and a take-profit at $8. In this case, you will benefit if the stock keeps falling or when it makes a bullish comeback.

It is recommended that you ensure that you exit your trades by the end of the day. This recommendation stems from the fact that a single whipsaws lead to highly volatile markets. Leaving your trades open in this period could expose you to significant loses.

Precautions to protect you from whipsaws

There are a number of precautions that you need to take to protect yourself from a whipsaw. First, always ensure that you have a take-profit and a stop-loss. These two stops will help to protect your trades when a whipsaw happens.

Second, there is a concept of position sizing. This is where you size your trades well in a bid to reduce the amount of risk. A small position size means that you will not make a lot of money per trade. It also means that you will not lose a lot of money in case of a whipsaw.

Finally, you should avoid leaving your trades open overnight. Overnight trades can lead to a substantial losses since a whipsaw can happen when the market opens.

Final thoughts

In this article, we have looked at what a whipsaw is, why it happens, and some of the strategies to use when it happens.

As we have said, identifying this market condition in advance is not simple at all, but it is important to know how to react appropriately as soon as we realize that it is in progress. It is precisely for this reason that we have also looked at some of the precautions to take.

Esternal useful Resources

- What your whipsaw trades are really telling you – Trader’s Nest