The financial market tends to go through cycles. At times,

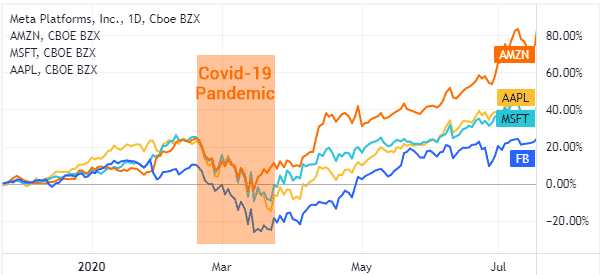

as we saw during the Covid-19 pandemic, the market goes through a strong bullish cycle. In other times, as happened in 2022, most assets like cryptocurrencies and stocks went through a major bearish trend as the Federal Reserve turned hawkish.

In this article, we will explain some of the top strategies for day trading in a bear market.

What is a bear market?

A bear market is a period when stocks and other assets are in a sharp downward trend. Precisely, a bear market happens when these assets crash by more than 20% from their previous high.

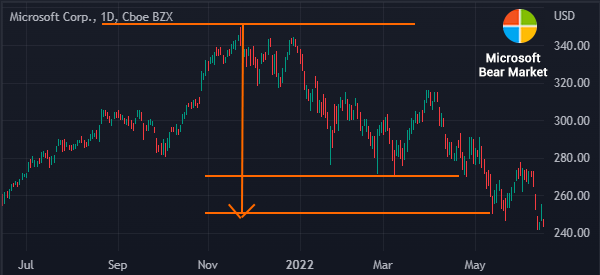

For example, the chart below shows that the Microsoft stock price dropped by 23% from its highest point in November 2021 and June 2022. This means that the stock moved to a bear market in this period.

A bear market has a minor difference with a correction. A correction happens when an asset declines by about 10% from its highest point.

Causes of a bear market

There are several key causes of a bear market. First, the actions of the Federal Reserve have a major impact on financial assets. In most cases, an easy-money policy by the Fed usually leads to a sharp increase in asset prices.

For example, stocks surged during the pandemic when the Fed decided to lower interest rates and implement quantitative easing.

Corporate issues

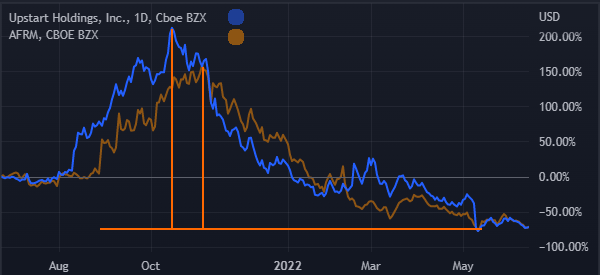

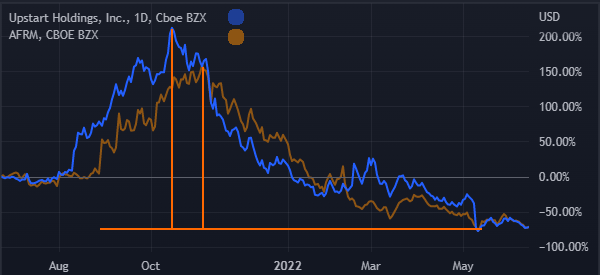

Second, a bear market can happen because of corporate issues. For example, as shown below, shares of Upstart declined sharply in 2021 and 2022 as the company warned of its slow growth. Other fintech companies that moved to a bear market are firms like Affirm, PayPal, and Block.

Natural Issues

Third, a bear market can happen because of natural issues. A good example is what happened during the Covid-19 pandemic. At the time, stocks declined sharply as states moved to implement lockdowns for the first time in almost a century.

Similarly, in 2011, Japanese stocks moved into a bear market because of the large earthquake that happened.

There are other causes of bear market in the stock market. For example, bear markets can be caused by technical issues, valuation concerns, product issues, and a major investigation.

Is day trading in a bear market possible?

Ideally, the only people who suffer during a bear market are investors who buy and hold assets. These investors suffer since their assets see a sharp decline during the bear market.

For example, well-known investors like Warren Buffet, Bill Ackman, and David Einhorn lost a substantial amount of money in 2022 when stocks suffered a major pullback.

On the other hand, traders usually make money during a bear market for three reasons.

Easy short

First, they can easily short falling stocks and then exit their trades before the day ends. Shorting is a trading strategy that lets people benefit when an asset is in a downward trend. It can be executed by just pressing a sell button in the trading platform.

Very short term

Second, day traders focus on extremely short-term market movements. As such, they can easily buy stocks that are rising in a bear market. Regardless of market conditions, there will always be some stocks make intraday pops.

Bear market strategies

Third, there are some day trading strategies that are primarily designed to be used in a bear market. For example, scalping is a strategy that can work well even in a bear market.

How to day trade in a bear market

Therefore, the most common question among traders is on how you can make money during a bear market. Fortunately, there are some useful approaches that will help you thrive in this period.

Identify a bear market

First, you need to know the market cycle that the market is. The best way to look at it is to focus on the key market indices like the Dow Jones and the Nasdaq 100. Ideally, a simple look at these indices will give you more information about whether the market is in a bear market or not.

Related » Index trading: Is It better to invest or trade?

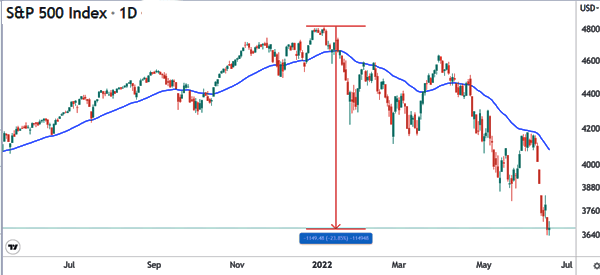

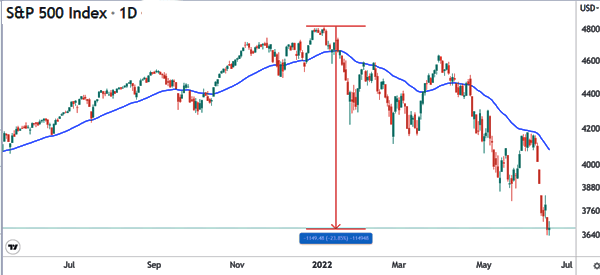

For example, the chart below shows that the S&P 500 moved to a bear market in 2022 as it fell by more than 20% from its high. This means that the broader market could be in a bear market.

Trend-following

One of the best trading strategies for trading in a bear market is known as trend-following. The concept behind it is relatively simple. You identify an existing trend and then follow it by shorting the asset.

There are several strategies for doing this. First, you can use the concept of trendlines. A trendline is a line that connects several points in a descending trendline. As a result, you can assume that the downward trend will continue as long as the price is below the line.

Second, you can use trend-following indicators like Bollinger Bands and moving averages. In a bearish trend, the asset will always remain below the moving averages as you can see in the chart below.

Second, you can fade the rally in a bear market. The idea is that an asset in a bear market will often make a pullback as some investors buy the dip.

Therefore, you can use these pullbacks as a way to place sell trades. As shown below, the moving average provides a great opportunity to fade the rally as the price retreats when it tests the level.

Use pre-market information

Another trading strategy is that of using data in the premarket. By looking at the trending assets in the pre-market, you will be at a good position to make money by buying those that are rising and even shorting those that are falling.

In line with this, you can use level 2 and time and sales data to determine what assets to buy or sell in the market. Most importantly, you can use a watchlist to determine the assets that you will buy or short.

Related » How to Get the Most Out of Your Daily Stock Watchlist

Summary

In this article, we have looked at what a bear market is and how it works. We have also highlighted some of the top strategies to use when trading in a bear market. You can experiment with other strategies like buying the dip and algorithmic trading.

External useful resources

- How do day traders make money in a bear market? – Quora