Most online brokers provide their clients with a free demo or practice account. This account is exactly similar to a real account, with the main difference being that the money in it is not real.

The main goal of a demo account is to help new traders learn the ropes of trading without risking their capital.

In this article, we will look at the benefits of using a demo account and the best strategies to use it as a day trader. At Real Trading, all our traders get access to a demo account that is known as Trading Mode Superb (TMS).

How a demo account works

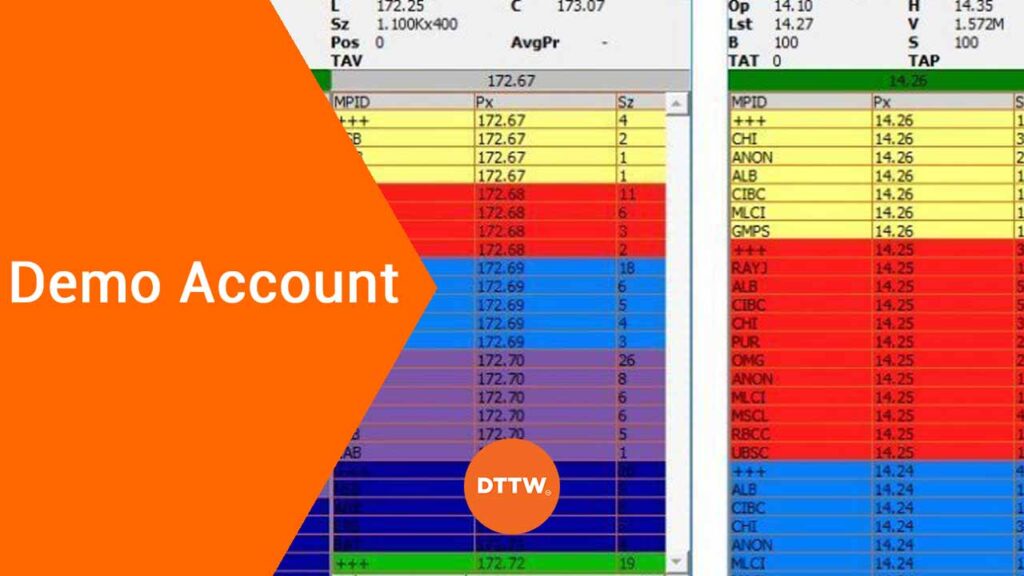

As mentioned above, a demo account is relatively similar to a real account with the only difference being that the account does not have real money. The account has access to all information that traders in a live account see.

For example, if Amazon’s shares move by 5% today, the same price action will be seen in a demo account.

For new traders, a demo account is the best introduction to the financial market. This is because they get a chance to experience how the market works. Indeed, most traders decide whether to move to a live account by observing the performance of the demo account.

You don’t need to be signed up to a broker to create a demo account. The easiest approach to having a demo is to just download the popular MetaTrader 4 or 5 platform in your computer or smartphone and just complete the process.

How experienced traders use demo accounts

Demo accounts are not only for new starters. Experienced traders, too, use the accounts to do several things.

Test new strategies

First, they use a demo account to test new strategies. For example, if you are a new trader who focuses on the scalping strategy, you might need to test a new swing trading approach. To do this in your live account would be a dangerous thing.

Similarly, if you are a stocks trader who is experimenting on stocks trading, a demo account comes in handy. Therefore, traders use the demo as a place to test whether trading indicators can work well together.

Test trading robots/algorithms

Second, experienced developers use demo accounts to test their trading robots, expert advisors, or algorithms. These are technical tools that open and close trades or send signals to traders. Since the process of developing these bots is usually long and risky, developers use demo accounts to create and backtest their algorithms.

Train new traders

Another role of a demo account is to help you train new traders. This applies whether you are a retail trader or part of an institutional company. For example, at Real Trading, all new traders are required to remain in the TMS for a few months. In this period, the floor manager is tasked with training new traders about trading.

Traders who work in large companies like hedge funds and investment banks are usually trained in a demo account. Further, if you make money by training other people, you can use the demo account to do that.

Improve your skills

A demo account is a useful tool to help improve your hard and soft skills when trading. Since the demo account does not risk your money, you can use it to boost key skills that are needed to trade. Some of the most important hard skills that it will help you with are:

- technical analysis

- fundamental analysis

- robot creation

- data analysis

On the other hand, some of the most popular soft skills that your demo account will help you with are: patience, persistence, confidence, and flexibility.

Boost your confidence

Trading can be a highly complicated process, and in most cases, it can lead to a lack of confidence. This happens more when a trader loses money or when they see another person losing money.

Therefore, in this case, a demo account can help them boost their confidence since one does not risk their funds. This is important because a highly confident trader often makes more money than those who don’t.

How to properly use the demo account

While a demo account is an important tool, many people use it wrongly. As such, they don’t realize the total value of the platform. You can address these issues in various ways.

First, ensure that you take the demo account seriously. While the funds in it are fake, you should always assume that it is real. As such, you should feel bad when you lose money in a demo account.

Related » 10 Handy Tips for Demo Mode!

Second, you can open a demo account with an unlimited amount of money. However, it is never advisable to open an account with all that money. Instead, you should open a demo with the amount of money that you plan to start trading with.

The benefit of doing this is that it will give you a sense of the amount of money you would make or lose.

Third, always select the leverage that you will start trading with. Like with the account amount, this will make you experience the market in the same way you would when trading in a live account.

Finally, we recommend that you prepare your transition from a demo account to a live account well. You should not move from a demo to a live account instantly. When you do this, you will typically make some mistakes.

One way of doing this is by creating an account with the same amount you intend to start with. If your goal is to start trading with $10,000, you should create a demo account with that amount and then trade with it for a while. If the strategy is successful, then you should transition to a live account.

Final thoughts

A demo account is an excellent platform used by both experienced and beginner traders. For beginners, it can help you master the art and science of trading. For experienced traders, it is an excellent platform to experiment on new strategies and build new skills.

External Useful Resources

- Are Demo Accounts An Indicator of Investing Skills? – Investing