Proprietary trading is a relatively common trading approaches these days. Commonly known as prop trading, the process involves trading using a company’s money and then takes a cut from the profit they generate.

In this article, we will explain what prop trading is, compare it with retail trading, and then explain why it is a better approach.

What is a prop trading firm?

A prop trading firm is a company that provides trading solutions to people from around the world. The company allows people to sign up as traders and then it provides them with liquidity. The firm then makes money from the profits that these traders generate.

There are many prop trading firms around. We believe that Real Trading offers the best features to traders.

It has the hardware and software that helps traders from around the world be successful. Also, the company promotes the creation of trading floors, which provide an ideal opportunity for people to make money.

There are other prop trading firms around. Some of the most popular ones are FTMO, The Funded Trader, and The 5%ers. Unlike Real Trading, these prop trading companies focus on forex trading and they provide their services using the MT4 and 5 software.

We are different because we have our own proprietary software, more than 50 markets, and most importantly, we provide direct market access (DMA).

Related » Is Day Trading Riskier Than Long-Term Investing?

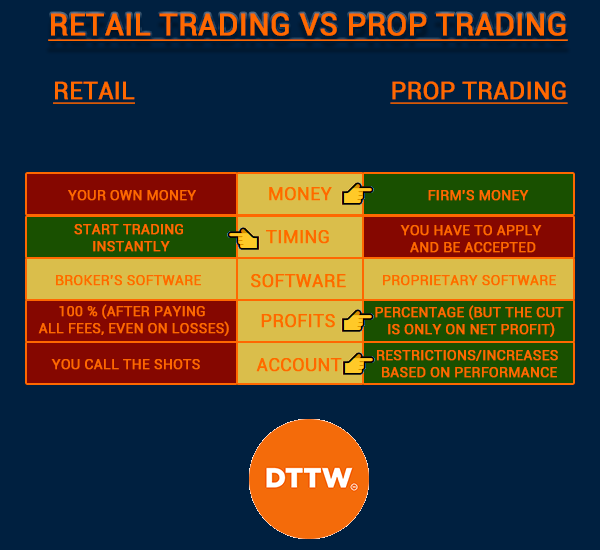

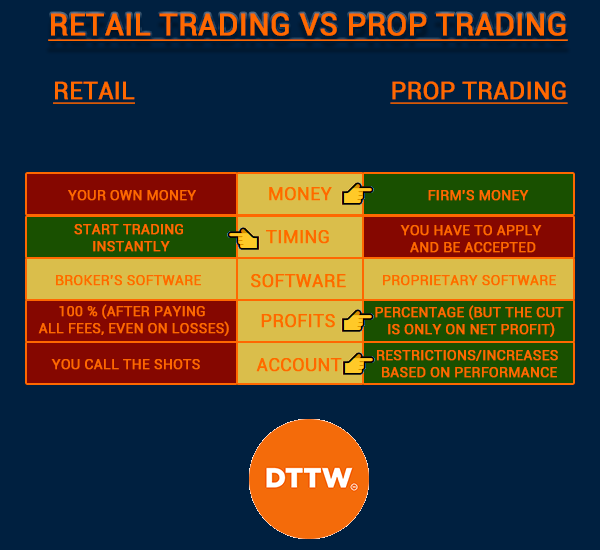

Retail trading vs prop trading

Retail trading is the most popular approach of making money in the financial market. It is what most people do since it involves creating an account with a broker like Robinhood, Schwab, and FxPro and then trading.

As a retail trader, you use your own money and You are also responsible for using your own strategies to trade. Most importantly, you can create your account and start trading instantly.

Prop trading is significantly different from that. First, at times, you have to apply before you are accepted. These companies do that because they are risking their own funds to let you trade.

Second, these companies tend to have their proprietary software that is used to conduct analysis in the market.

Third, in prop trading, you will typically keep an agreed part of your profits, with the rest amount going to the company. In most cases, the trader usually keeps over 60% of the profits, but with Us the trader’s share is much higher (up to 91 percent, depending on the asset).

Fourth, in retail trading, you typically call the shots since you own the account. In prop trading, you can be asked to stop trading depending on your overall performance.

Related » Retail vs Prop Trading, full guide

Advantages of using a prop trading firm

There are many benefits of using a prop trading firm in the market. First, you don’t need a lot of money to start with. Many prop firms just need your expertise. If you prove it in a demo account, these companies will go ahead and fund you. In retail trading, you are required to have a substantial initial capital.

Second, these companies fund you more. In many cases, the company will give you more money than what you have already. As a result, this means that you can make more money if the trades work out well.

Further, prop trading firms like Us provide you with a direct market access that allows you to select your own market maker. In most retail cases, DMA is not provided by regular brokers like Robinhood, Fidelity, and Schwab.

Related » DMA vs Retail Trading

Third, some prop firms encourage you to be part of a team. In fact, the business model of Real Trading is to encourage people to create teams and operate as a trading floor.

Fourth, since their money is at stake, prop trading firms provide more education and mentorship solutions to traders. Ideally, they mostly use their best-performing traders to provide these solutions.

Last but not least, prop trading firms give you more prospects for being a full-time trader. This is unlike what retail trading firms do.

Related » Mistakes to Avoid Becoming a Full-Time Trader

How to set-up your prop trading desk

The process of setting your prop trading desk is relatively simple. First, you need to select a good company that offers these services. You should go for a company that offers a friendly trading software and one that has more trading assets. Further, the prop trading company should have a good approach to share profits.

Second, perfect your trading strategy using a demo account. This is a simulator that provides you with live information that you can then apply in the market.

This demo will show you whether your trading approach is working or not. Some prop firms like Real Trading don’t require you to have experience in the market.

Third, read the terms and conditions that the firm offers and then get started. As you advance with Us, it is recommended that you bring in more people in your floor.

Ensure that your trading desk is in a conducive and quiet environment. At the same time, ensure that you have fast computers and internet.

Related » How to Setup Your Day Trading Room

Getting started as a prop trader

There are different types of prop trading firms. For example, some, like The 5%ers, allow anyone to start trading providing that they pay a certain amount of money. With these payments, the trader will be given cash, which they can start to trade with.

Others, like FTMO take traders through a long evaluation process. Only those who make it through this process can go ahead and become traders.

On the other hand, at Real Trading, all you need to do is to sign up, pay a small fee for the hardware and then you can get started after some training.

FAQs

Is prop trading worth it?

Is prop trading illegal?

Is prop trading risky?

How are prop traders taxed?

External useful resources

- The Ultimate Guide for choosing the best Prop trading firm – Start Business Online