A range-bound market refers to a situation where financial assets are not going anywhere. For example, when a stock oscillates between $10 and $12 for a few weeks, it can be said to be a range-bound market.

This situation is one of the least loved by day traders, because it is much more difficult to identify good opportunities to enter/exit the market and make some profit. More difficult, but not impossible.

In this article, we will briefly look at what a range-bound market is, why it happens, and some of the range-bound trading strategies you can use.

What is a range-bound market?

As mentioned, a range-bound market is a period when an asset like a stock, commodity, exchange-traded fund (ETF), and a currency pair is in a narrow range. In the chart below, we see that the ExxonMobil share price was in a relatively narrow range.

A range-bound market is often the worst for traders since it tends to have no major buying and selling opportunities. Indeed, in the past, we have seen many investment banks like Goldman Sachs and Morgan Stanley record low earnings in periods of low volatility.

Why a range market happens

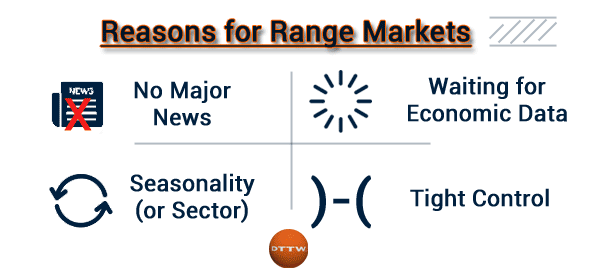

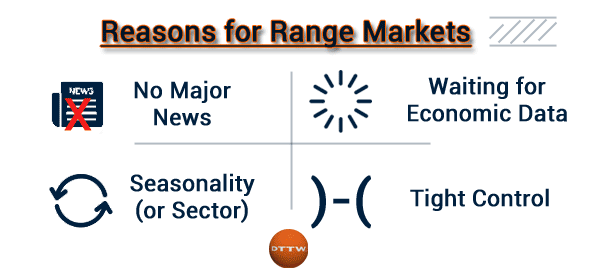

There are several reasons why markets remain in a relatively narrow range.

First, stocks tend to remain in a narrow range when there is no major news about a company or the economy. During this time, the demand and supply of stocks and other assets to be in equilibrium.

Second, at times, stocks tend to remain in a tight range because of seasonality reasons. For example, in most cases, stocks remain in a narrow range during summer as more institutional investors go to holiday. During this period, there is usually a significantly low volume.

Also, we tend to see low volatility in the final week of the year. During this time, many investors tend to be in holiday.

Third, at times, there is low volatility when the market is waiting for a major economic data or event. When this happens, investors tend to be unsure of whether to buy or short a financial asset. As a result, this usually leads to relatively low volatility.

In addition, some sectors tend to remain in a narrow range for a long period. These are some boring sectors like forestry and industrial.

Another reason is that some assets are usually in a tight control. For example, the USD/HKD pair is usually in a tight range because the Hong Kong dollar is usually pegged to the US dollar. As such, there is usually no need to buy or go short the currency since it is usually highly predictable.

Strategies to trade in a range-bound market

There are several approaches to trade during a range-bound market. First, you need to look beneath the surface and identify stocks that are showing signs of volatility. For example, at times, the S&P 500 index can be in a tight range for months. During this time, many companies in the index could be showing some signs of strong volatility.

Therefore, we recommend that you dig deeper to identify stocks that are showing signs of volatility. There are several ways of doing this.

Look for top moving stocks

First, you can look at the top moving stocks during the premarket and during the regular session. You can use the free tools provided by companies like Investing.com and Market Chamelion to find these stocks.

Second, you can subscribe to a market watchlist that gives you the latest top movers and the reasons why they are moving. At Real Trading, we have a free watchlist that gives you a breakdown of the most important companies.

Breakouts

Another approach of trading in range-bound markets is to trade in breakouts. A breakout happens when a range ends and an asset starts a new trend. This breakout may happen organically or it can be triggered by an external factor like a news event, an earnings report, or a policy issue.

There are several ways you can trade a breakout but the most common one is that of using pending orders. A pending order is one that is executed at a certain level. For example, if a stock is trading at $20, you could place a buy-stop order at $22. A buy trade will be implemented when the asset moves to that level.

Trading breakouts using pending orders can be a highly profitable thing to do since it is usually the beginning of a new trend.

Scalping

Another relatively common strategy when trading breakouts is known as scalping. This is where you decide to make small profits when the asset is in a range. For example, if the stock has formed a horizontal channel between $20 and $22, you could place a buy trade when it drops to $20 and a short trade when it moves to $22.

While these are small profits, they will most likely add up over time. We highly recommend that you use this strategy during the regular session when market activity has cooled a bit.

Summary: How to behave during a range bound market?

Range-bound markets can be boring to many traders. However, in this article, we have looked at what a range-bound market is and some of the top strategies you can use to make money during this time.

External Useful Resources

- Swing Trade Range-Bound Stock Strategies – Dummies